Bitcoin Whales Are Selling — Is a May 30 Crypto Crash Coming?

Bitcoin is back in the spotlight — not because of a breakout, but because of a potential storm on the horizon. With price rejection at the $105,000 resistance level, major whales offloading BTC, and over $5 billion in creditor funds set to be released on May 30, traders are bracing for a sharp correction. But beneath the charts lies a deeper story — a psychological one.

This article unpacks the trader psychology behind current market behavior and what it means for your next move.

📉 1. Price Rejection at $105K: A Classic Psychological Barrier

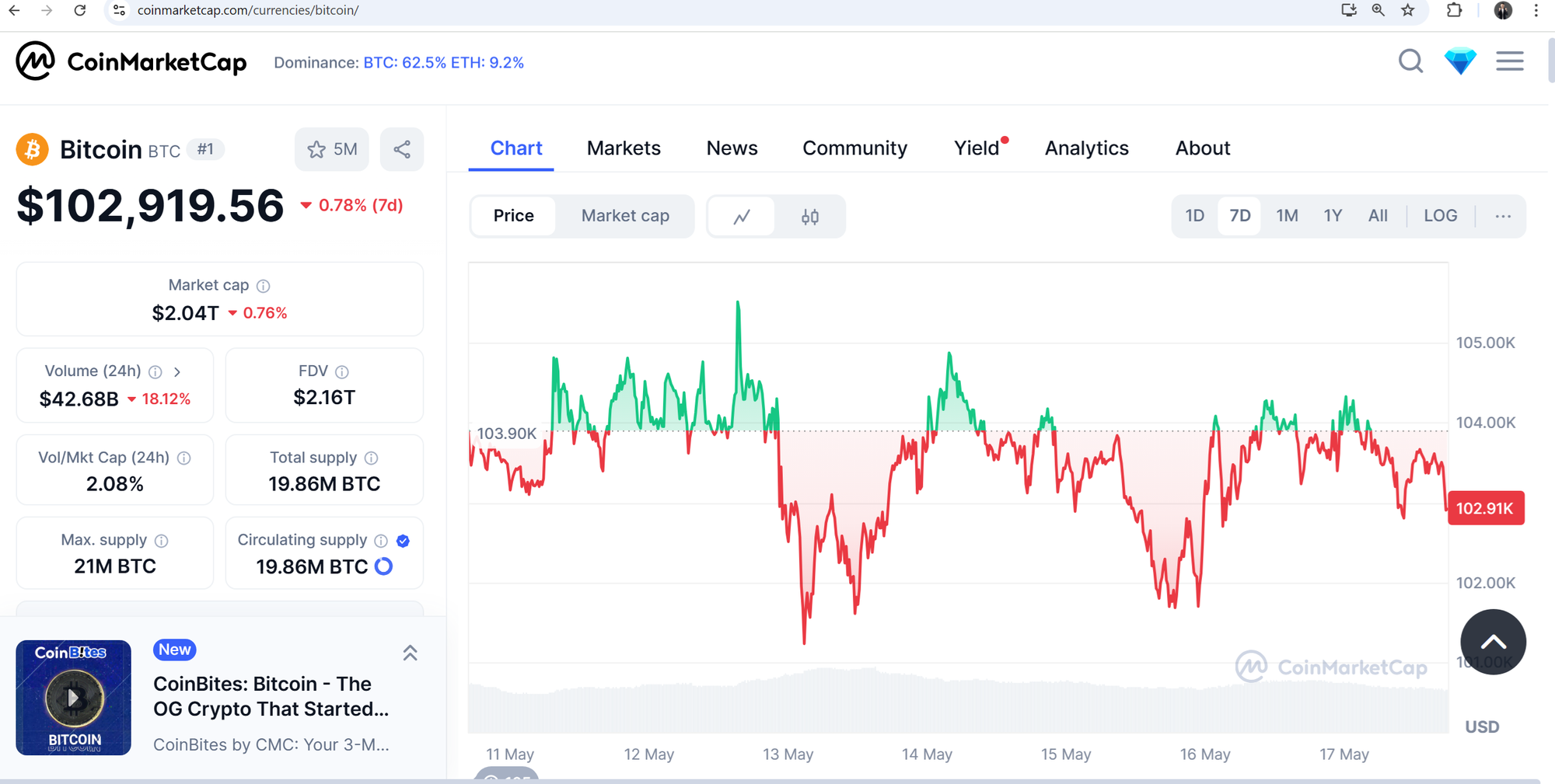

BTC/USD is hovering around $103,500, unable to breach the $105,000 resistance. This is not just technical — it's psychological.

What it means:

Repeated rejection at a key level conditions traders to expect failure, making them hesitant to buy. This creates a self-fulfilling resistance wall.

What traders should do:

Don’t buy into weakness. Let the market prove its strength by reclaiming $105K on volume. Until then, wait or prepare for short setups.

🐋 2. Whales Sold 30,000 BTC — Why That Matters Emotionally

Large holders (a.k.a. whales) have dumped 30,000 BTC in just 3 days. IntoTheBlock data confirms a distribution pattern, with whale netflows dropping 176% over 7 days and 71% over 30 days.

Trader psychology insight:

When whales exit quietly, they don’t panic. But they know something. Their behavior signals a lack of conviction in further short-term upside.

What traders should do:

Follow the smart money, not the hype. Scale out if you’re in profits, or tighten stop-losses. Avoid new longs unless you see strength backed by data.

📅 3. The May 30 Trigger — FTX $5 Billion Distribution

FTX plans to release $5 billion to creditors on May 30. These creditors may liquidate assets once unlocked, potentially causing a cascade of selling pressure.

The mental effect:

This event is a ticking clock. Traders will either front-run the dump (causing early sell-offs) or panic afterward. Either way, it injects fear.

What traders should do:

Watch order books around May 28–31. Look for increased exchange inflows. Stay nimble — the volatility spike could offer both short and long scalp opportunities.

📊 4. Derivatives Show Activity Without Confidence

- Options volume up 45%

- Futures volume up 36%

- But open interest in options is down 5%, and futures OI is barely up 1%

Behavioral signal:

Traders are actively betting — but without conviction. They’re not building strong long positions. This signals hesitation and fear of traps.

What traders should do:

Avoid overleveraging. If you trade options, skew towards neutral or volatility-focused strategies (e.g., straddles or spreads). Don't assume trend continuation — the market doesn't believe it yet.

💰 5. Stablecoin Ratio Is Rising — That’s a Waiting Game

The Exchange Stablecoin Ratio rose 4.49%, meaning more buying power is sitting on the sidelines.

Psychology angle:

Traders aren’t exiting crypto; they’re holding stablecoins, waiting for dips. This is classic "wait-for-the-crash" behavior.

What traders should do:

Prepare your buy zones now. Don’t chase green candles — plan your entries where fear is highest. Patience wins when others rush.

🔍 6. Long-Term Holders (LTH) NUPL Tells a Warning

According to Glassnode, the Bitcoin Long-Term Holder NUPL (Net Unrealized Profit/Loss) is at 0.69 — the same level as when BTC was just $85,000.

What this implies:

New LTHs from the December 2024 top are dragging down the group’s average unrealized profit. Despite BTC at $103,000+, long-term holders feel like they’re still at breakeven.

Emotional conclusion:

These LTHs are psychologically disappointed, not euphoric. No euphoria = no blow-off top = no sustained uptrend (yet).

What traders should do:

Expect chop. Don’t rely on "HODLers won’t sell." Some of them will — they’re emotionally fatigued and likely to take profit on any pump.

✅ Summary: What Should Smart Crypto Traders Do Now?

| Signal | Interpretation | Trader Action |

|---|---|---|

| Resistance at $105K | Psychological ceiling | Wait for breakout confirmation |

| Whale Distribution | Exit signal from pros | Reduce exposure or short |

| May 30 FTX Funds | Liquidity shock incoming | Avoid large positions before that date |

| Derivatives Data | Cautious participation | Use neutral or protective strategies |

| Stablecoin Ratio | Cash on sidelines | Set buy zones for dips |

| LTH NUPL at 0.69 | No strong belief in rally | Stay defensive |

🧠 Final Thought — The Market Isn't Scared. It's Suspicious.

This isn’t fear-based panic. It’s cautious skepticism driven by previous burns, macro uncertainty, and historical patterns. Smart traders know: when whales exit, stablecoins pile up, and derivatives heat up without commitment — the market is whispering “get ready.”