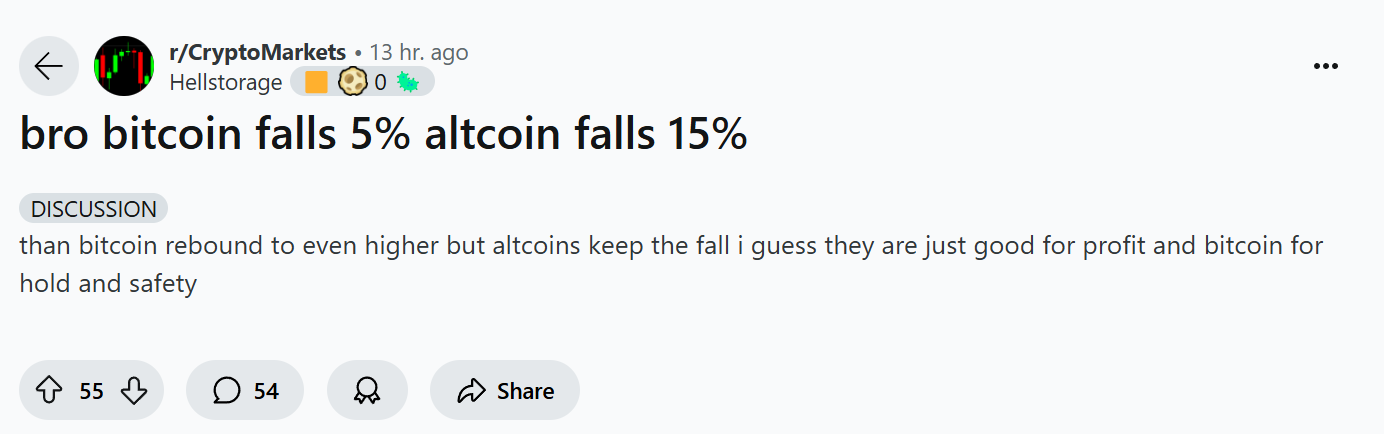

Bro bitcoin falls 5% altcoin falls 15% - Time to shop?

Key Takeaways:

- Bitcoin remains the safest long-term crypto investment, but with lower returns.

- Altcoins carry massive risk, but those with strong fundamentals can outperform BTC.

- Market cycles weed out weak projects—most altcoins don’t survive long-term.

- Institutional investors are focusing on Real World Assets (RWAs) over speculative meme coins.

- Timing and research matter: The right altcoin at the right time can 10x, but holding the wrong one can erase your gains.

Live Bitcoin Price:

The Hard Truth About Crypto Investing—And Why Most People Get Wrecked

Crypto markets move fast. One day, Bitcoin is pumping, and altcoins are riding the wave. The next day, MicroStrategy is down 40%, meme coins are crashing, and Bitcoin maximalists are celebrating.

If you're wondering where to put your money—BTC, alts, or something else—this article breaks down what’s happening, what’s really driving the market, and how smart investors navigate it.

Bitcoin vs. Altcoins: The Classic Dilemma

Reddit is buzzing with the same debate: “Should I go all-in on BTC or gamble on alts?”

Some, like SST114, believe in a balanced portfolio:

“Most of your crypto port should be allocated to BTC, then some side money on fundamentally strong potentials and RWAs, not junk and vaporware.”

Meanwhile, others warn that altcoins can be a quick road to riches—or ruin:

"Altcoin high risk—you may lose more than half at once, but also gain similarly. Research is everything." – Hellstorage

This argument has been around for years. But let’s look at what history tells us.

What Happened in Previous Market Cycles?

Case Study #1: The 2017 Altcoin Boom & Bust

- In late 2017, altcoins like XRP, ADA, and NEO surged 1,000%+ in weeks.

- By 2018, most lost 90% or more of their value.

- Bitcoin, while also crashing, remained dominant and eventually recovered.

Case Study #2: The 2021 Meme Coin Craze

- DOGE and SHIB saw mind-blowing gains, but most meme coins vanished into irrelevance.

- Investors who took profits made fortunes. Those who held blindly got wrecked.

The lesson?

Timing and fundamentals matter. Picking a strong project before it takes off is difficult—but holding onto hype-based tokens for too long is a guaranteed way to lose money.

Current Developments: The Next Market Trend?

1️⃣ Bitcoin Dominance Increasing

- Bitcoin remains the safest store of value in crypto.

- Institutional money (like BlackRock’s ETF) prefers BTC over high-risk alts.

- Historically, rising BTC dominance signals an upcoming altcoin flush-out.

2️⃣ Altcoin Markets in Chaos

- Many investors are chasing meme coins again.

- Strong fundamentals matter—projects like HBAR and RWAs (real-world assets) are catching Wall Street’s attention.

3️⃣ The Meme Coin Bubble (Again?)

Like 2021, meme coins are pumping. But as SST114 pointed out:

“All that vaporware and oversaturation needs to get flushed.”

If history repeats itself, most speculative projects will collapse, while well-researched investments will thrive.

How to Profit Without Getting Rekt

✅ Safe Route: Hold Bitcoin and wait. BTC has historically recovered every cycle.

🚀 High-Risk, High-Reward Route: Find altcoins with real fundamentals before they pump—but take profits along the way.

⚠️ What to Avoid: Hype-driven projects with no real-world use case. The market eventually punishes these.

Pro Investor Strategy:

- Allocate Wisely → Keep at least 50-70% in BTC.

- Research Alts → Focus on RWAs and fundamentally strong assets.

- Take Profits → Don’t wait for 100x. A 5-10x gain is a win—secure profits before the market shifts.

Final Thoughts: Are You a Casino Gambler or a Strategic Investor?

If your strategy is hoping that a $100 investment in a random meme coin will make you a millionaire, you’re gambling.

If you allocate capital wisely, research the right projects, and manage risk, you’re investing.

The choice is yours.

🚀 What’s your strategy this cycle? Comment below and let’s discuss.

Disclaimer:

This article is for informational purposes only and is not financial advice. Crypto investments carry risks—always do your own research before investing.