Bybit Hacked by North Korea's Lazarus Group? Exposed!

Afraid You're Next? How North Korea’s US$1.5 Billion Bybit Hack Exposes Your Crypto Security Flaws—and Exactly What to Do About It

Key Takeaways:

- North Korea’s Lazarus Group suspected in largest-ever crypto hack, stealing US$1.5 billion from Bybit’s Ethereum cold wallet.

- Bybit assures full compensation for users, safeguarding trust despite the massive theft.

- Crypto hacking linked to North Korea surged from US$1.3 billion in 2024 to this new record.

- Ethereum briefly dipped by 4%, demonstrating market sensitivity to major security breaches.

- Investors are urged to reassess security measures of crypto exchanges they use.

The Situation Explained:

On February 21, 2025, cryptocurrency exchange Bybit suffered an unprecedented breach when attackers drained approximately US$1.5 billion worth of Ethereum (ETH) from its cold wallet. This staggering theft eclipses the previous record—a US$620 million hack from the Ronin Network in 2022, which also involved North Korea’s notorious Lazarus Group.

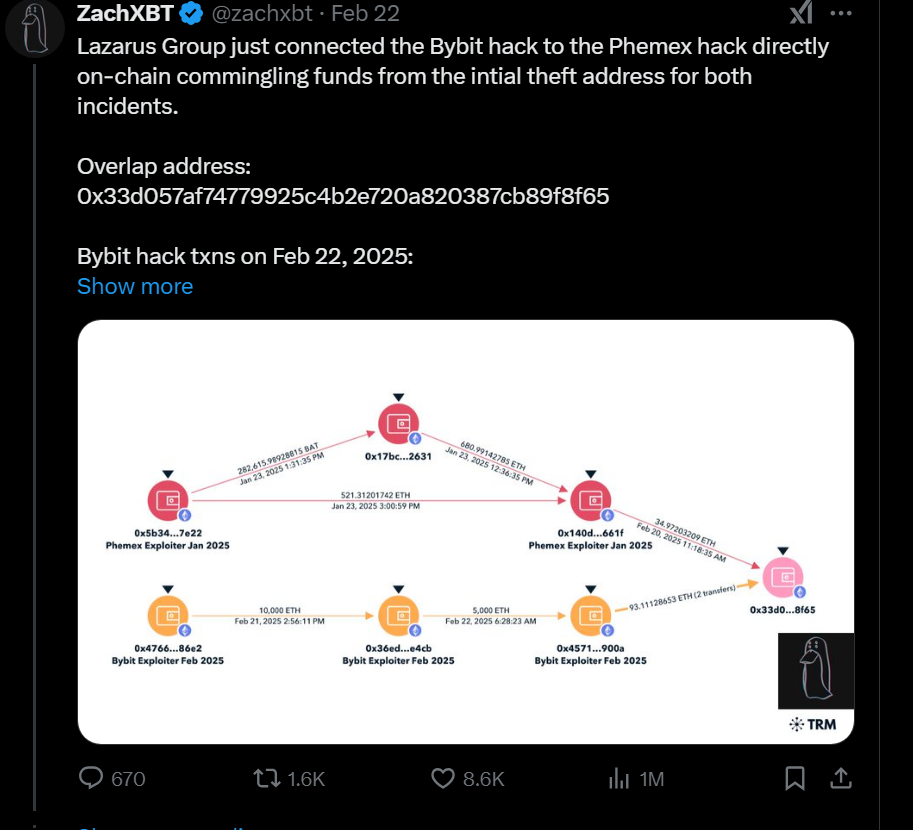

Blockchain analytics firms Arkham Intelligence, Elliptic, and renowned crypto analyst ZachXBT traced the stolen assets directly to Lazarus, a hacking unit controlled by North Korea’s Reconnaissance General Bureau. Lazarus Group has an alarming history, linked to infamous incidents like the "WannaCry" ransomware attacks and major financial cyberattacks globally.

Despite the magnitude of this attack, Bybit CEO Ben Zhou promptly assured investors and clients that their assets remain fully backed and that the company is solvent, even without recovery of the stolen ETH. Bybit also announced an immediate reimbursement program for affected users, highlighting the exchange’s commitment to maintaining trust and stability.

Real-World Case Study:

Reflecting on historical events, the Ronin Network hack in 2022 offers insight into potential outcomes. After the Lazarus Group stole US$620 million, only partial funds were recovered. This event highlighted vulnerabilities in crypto security protocols, prompting exchanges globally to elevate their cybersecurity standards significantly.

What It Means Now and for the Future:

The Bybit incident reinforces the urgent need for enhanced security frameworks in crypto exchanges. North Korea’s systematic targeting of crypto assets as a funding mechanism for its military program underlines the geopolitical implications of digital asset security.

Short-term impacts include market volatility, as witnessed by Ethereum’s 4% drop immediately after the hack. Long-term, it emphasizes rigorous security audits and increased regulatory oversight as non-negotiable standards for exchanges. Investors must prepare for stricter compliance and possibly higher fees as exchanges enhance protective measures.

What Does This Mean for Crypto Investors?

Crypto investors must recognize that even established exchanges can be vulnerable targets. Choosing exchanges with proven security track records and transparent asset backing (like Bybit’s immediate compensation approach) becomes critical.

Actionable Investor Takeaways:

- Diversify holdings across multiple exchanges and cold wallets to mitigate risk.

- Regularly review and update your security protocols (e.g., multi-factor authentication, hardware wallets).

- Stay informed about security standards and historical breach responses of exchanges before committing large funds.

- Follow developments on crypto insurance products aimed at mitigating financial losses from hacking incidents.

Investors who proactively secure their assets and remain vigilant to emerging threats will fare significantly better in the long run.

Disclaimer:

This article is intended for informational purposes only and does not constitute financial advice. Readers should conduct their own due diligence and consult with a professional financial advisor before making investment decisions.