Dogecoin (DOGE) Tokenomics Explained [2025] – Market Cap, Supply & Inflation Risks Compared

![Dogecoin (DOGE) Tokenomics Explained [2025] – Market Cap, Supply & Inflation Risks Compared](/content/images/size/w1200/2025/04/Dogecoin--DOGE--Tokenomics-Explained--2025----Market-Cap--Supply---Inflation-Risks-Compared.png)

Discover Dogecoin's real value in 2025 with full tokenomics breakdown — including current price, market cap, volume, supply, inflation risks, and how DOGE compares to SHIB, PEPE, and FLOKI. Learn how to assess memecoin risks and growth potential smartly.

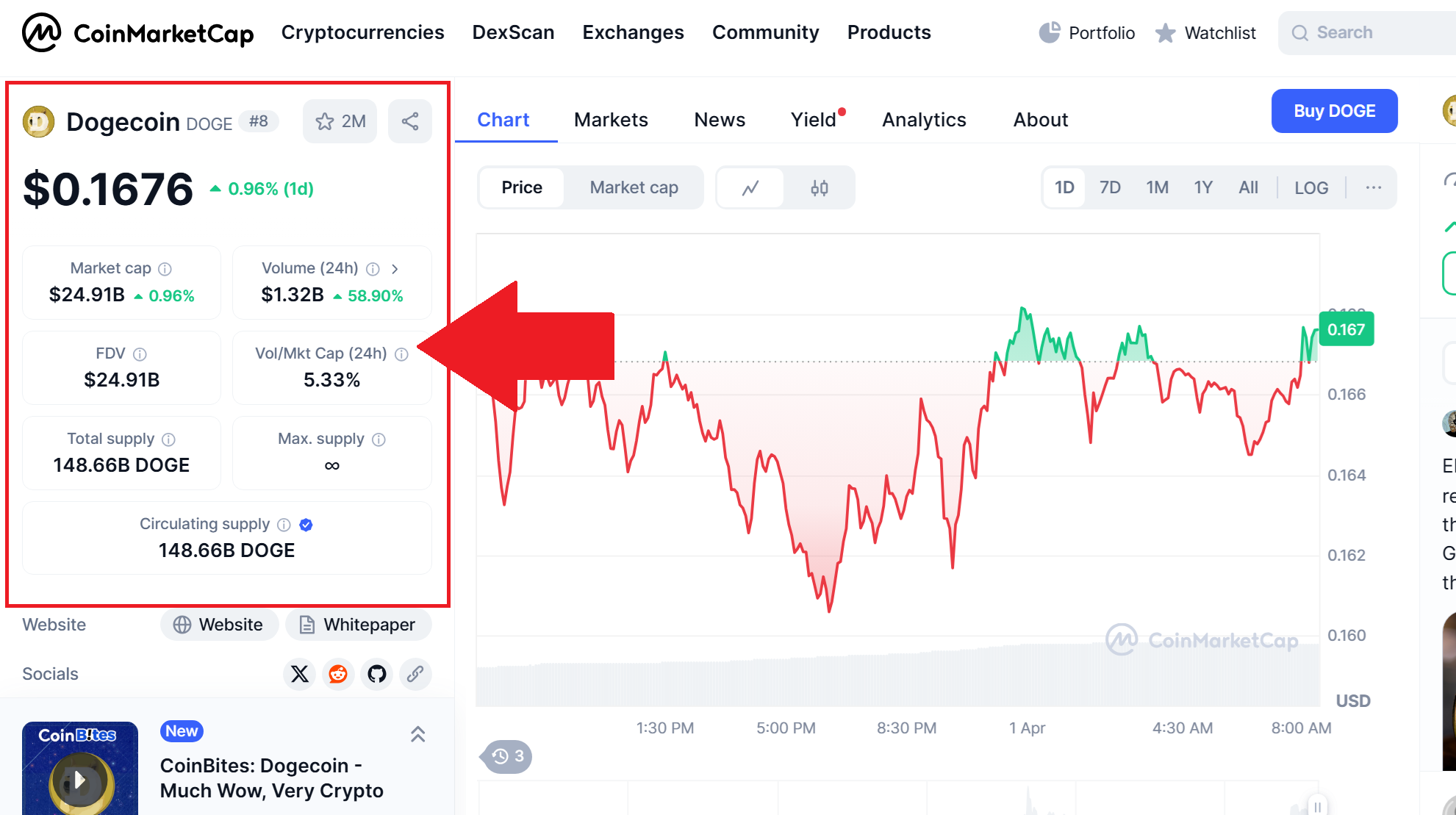

1. Current Price: $0.1676 as of 1/4/2025

This is the market price of one DOGE token. While price alone doesn’t define value, it shows how the market currently values each token.

2. Market Cap: $24.91 Billion

Market Cap = Price × Circulating Supply This is the total value of all DOGE tokens currently in circulation. A market cap of nearly $25 billion indicates that Dogecoin is a large-cap coin, with significant market trust and trading volume.

Dogecoin is the largest memecoin by market cap. For context:

- DOGE: ~$25 billion

- Shiba Inu (SHIB): ~$14 billion

- Pepe (PEPE): ~$3 billion

- Floki (FLOKI): ~$1 billion

3. Volume (24h): $1.32 Billion (+58.90%)

This is the total value of DOGE traded in the last 24 hours. A high and increasing volume (+58.90%) indicates strong market interest and liquidity. Traders and investors are actively buying and selling Dogecoin.

4. FDV (Fully Diluted Valuation): $24.91 Billion

FDV assumes that all possible tokens are in circulation. In DOGE's case, FDV = Market Cap because the circulating supply equals the total supply (both 148.66 billion). However, note that DOGE has no max supply (infinite symbol shown), meaning it is inflationary — new tokens are minted every year (about 5 billion DOGE annually), which can dilute value over time.

5. Volume / Market Cap Ratio: 5.33%

This tells us how much of the market cap is being traded daily. A ratio above 3% is considered healthy — 5.33% is very strong, showing that DOGE is actively traded and very liquid.

6. Total Supply: 148.66 Billion DOGE

This is the total number of DOGE that currently exists. Since DOGE has no cap, this number will continue to grow over time — this is a red flag for long-term scarcity, as it introduces constant inflation into the ecosystem.

7. Max Supply: ∞ (Unlimited)

This is one of the most important aspects of Dogecoin’s tokenomics. There is no hard cap on how many DOGE can ever exist, meaning the token supply will keep growing. This inflationary model is different from deflationary coins like Bitcoin (which has a 21M cap). As a result, DOGE’s value depends more on demand and utility, not scarcity.

8. Circulating Supply: 148.66 Billion DOGE

This confirms that all existing DOGE tokens are currently in circulation, and there are no tokens locked, vested, or waiting to be released — this is a green flag for transparency and no hidden dumping risks, but again, new tokens will be added every year.

✅ Summary of Dogecoin's Tokenomics:

- Green Flags:

- Fully circulating supply (no hidden or locked tokens)

- High liquidity and trading volume

- Established market presence and large community

- Simple, transparent emission model

- Red Flags:

- Unlimited supply (inflationary) — this may cause long-term price dilution

- No deflation or scarcity model, meaning value must come from utility, hype, or community use

- No clear token utility beyond tipping and community use cases

Dogecoin’s tokenomics shows us how an inflationary meme coin with strong community and liquidity can remain relevant. However, the unlimited supply is a risk for long-term value, unless demand consistently outweighs new issuance.

Subscribe to get notified about the next 100x Memecoin — free!

It Helps You Measure Risk and Growth Potential

Knowing that Dogecoin has a $25 billion market cap tells you that:

- It’s already a well-established project with less likelihood of disappearing overnight (unlike low-cap memecoins).

- But it also means the potential for 100x gains is low — because it’s harder for a large cap to multiply fast. For example, going from $25B to $250B (10x) would mean overtaking Ethereum, which is unrealistic unless something huge happens.

So the larger the market cap, the lower the risk — but also the lower the explosive upside.

🔍 2. It Helps You Compare Coins More Accurately than Price

Price alone doesn’t tell you much.

- DOGE is priced at $0.16,

- PEPE might be $0.000002 — but that doesn't mean PEPE is “cheap.”

Instead, look at market cap:

- DOGE is $25B

- PEPE is $3B

This shows that DOGE is actually 8x bigger than PEPE, despite the small-looking price.

👉 So if you're choosing between two coins, comparing market cap is smarter than comparing price.

📈 3. It Shows You Where the Crowd Is

Large market cap coins like DOGE attract:

- Institutional interest (more listings, integrations, liquidity)

- Media attention (covered on mainstream platforms)

- Community size and momentum

Knowing this helps you gauge how strong or sustainable the hype is — and whether you’re early or late to the game.

⚖️ 4. It Helps You Balance Your Portfolio

If you’re investing or trading, understanding market cap helps you:

- Balance your high-risk/high-reward bets (small caps)

- With lower-risk, stable bets (large caps like DOGE)

So your decisions are not based on guesswork or hype, but data and strategy.

🧩 Summary: Why It Matters

"Market cap tells you how big, how risky, and how realistic your profit expectations should be."

Understanding this helps you avoid rookie mistakes like:

- Thinking cheap coins = better opportunity

- Chasing 100x returns on already-large coins

- Not realizing the real size and popularity of a project