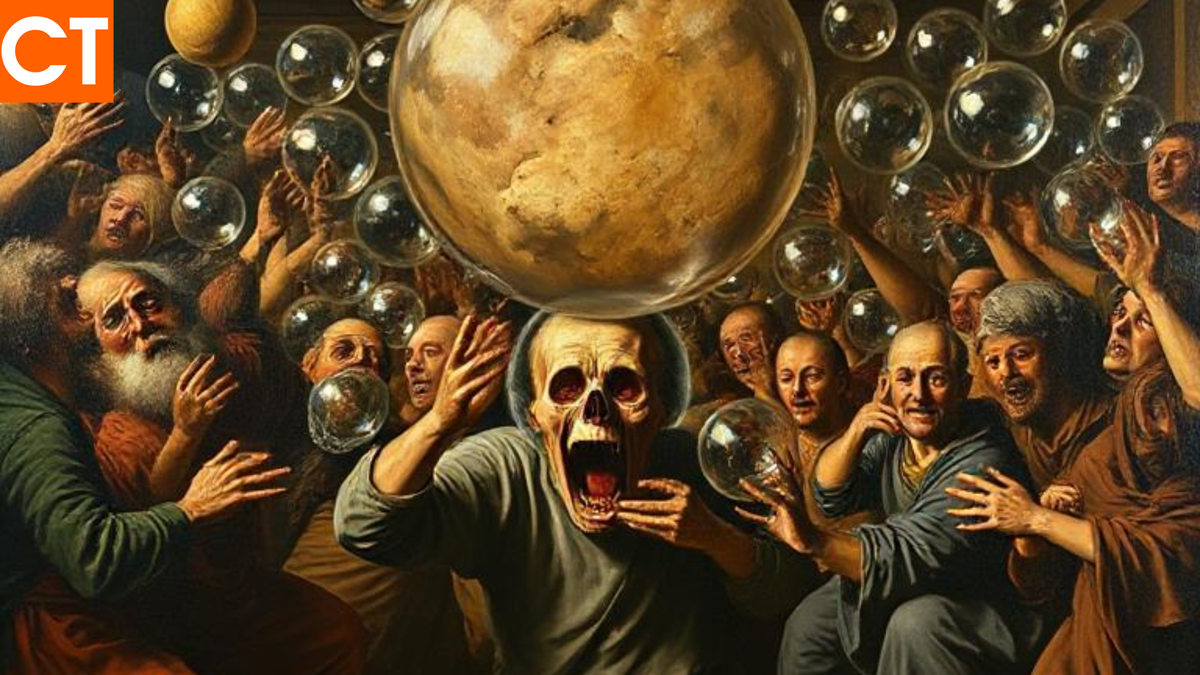

Fear, Greed & Market Bubbles: The Emotional Game of Crypto Trading!

In the volatile world of cryptocurrency trading, understanding the psychological forces that drive market cycles is crucial for both novice and seasoned investors. Emotions such as euphoria, fear, and herd mentality often dictate price movements, leading to significant financial consequences. By delving into these psychological phenomena, traders can develop strategies to maintain composure and make informed decisions in high-risk situations.

Herd Mentality and Its Impact on Crypto Prices

Herd mentality, or the tendency for individuals to mimic the actions of a larger group, plays a significant role in cryptocurrency markets. This behavior is often amplified in environments characterized by uncertainty and rapid change, such as the crypto market. Investors, especially those less experienced, may assume that the majority possesses superior information, leading them to follow collective actions without independent analysis. This can result in substantial price swings, as mass buying or selling drives prices beyond intrinsic values. kanga.exchange+1fastercapital.com+1

Euphoria and Market Bubbles

Euphoria occurs when investors become excessively optimistic about market prospects, often disregarding fundamental valuations. This heightened state of emotion can lead to speculative bubbles, where asset prices soar based on exuberant expectations rather than intrinsic worth. The cryptocurrency market has witnessed such phases, where rapid price increases attract more investors, further inflating the bubble until it becomes unsustainable.

Capitulation: The Aftermath of Market Peaks

Capitulation refers to the point in a declining market when investors, driven by panic and loss aversion, decide to sell their holdings, accepting losses to prevent further declines. This mass surrender often marks the bottom of a market cycle, as widespread selling pressure diminishes. In the crypto market, capitulation can lead to sharp price drops, creating opportunities for informed investors to enter at lower prices.

Real-Life Example: The 2021 Bitcoin Bull Run and Subsequent Correction

A notable instance illustrating these psychological phases is the 2021 Bitcoin bull run. During this period, Bitcoin's price surged to unprecedented levels, driven by widespread euphoria and a fear of missing out (FOMO). Retail investors, influenced by herd mentality, poured into the market, pushing prices higher without thorough due diligence. However, as regulatory concerns emerged and market sentiment shifted, a sharp correction ensued. Many late entrants faced significant losses, leading to a phase of capitulation where panic selling was prevalent.

Strategies for Maintaining Composure in Volatile Markets

To navigate the emotional complexities of crypto trading, investors can adopt several strategies:

- Develop a Resilient Mindset: Understanding that volatility is inherent in cryptocurrency markets can help set realistic expectations. Recognizing that both gains and losses are part of the trading experience fosters emotional resilience.

- Implement Risk Management Techniques: Setting stop-loss orders and diversifying portfolios can mitigate potential losses. By defining acceptable risk levels, traders can prevent emotions from dictating their decisions during market fluctuations.

- Continuous Education and Research: Staying informed about market developments, technological advancements, and regulatory changes enables traders to make decisions based on data rather than emotions. Engaging with reputable sources and avoiding hype-driven news can provide a balanced perspective.

- Practice Mindfulness and Stress Management: Techniques such as meditation, regular exercise, and adequate rest can improve mental well-being, allowing traders to approach the market with a clear and focused mind.

Conclusion

The psychology of market cycles underscores the profound impact of collective emotions on cryptocurrency prices. By acknowledging and understanding phenomena like herd mentality, euphoria, and capitulation, traders can better anticipate market movements and develop strategies to maintain composure. Cultivating a resilient and informed mindset is essential for navigating the high-risk environment of crypto trading, ultimately contributing to long-term success.