How to Build an Unbreakable Crypto Trading Mindset Like a Professional Trader

Every trader enters the market hoping to win, but very few truly master the psychological resilience needed to survive and thrive. The difference between a professional trader and an emotional gambler is not just knowledge of technical indicators—it’s mindset. Trading is not just about strategy; it’s about emotional discipline, cognitive control, and mental resilience.

Why Most Traders Fail: The Psychological Trap

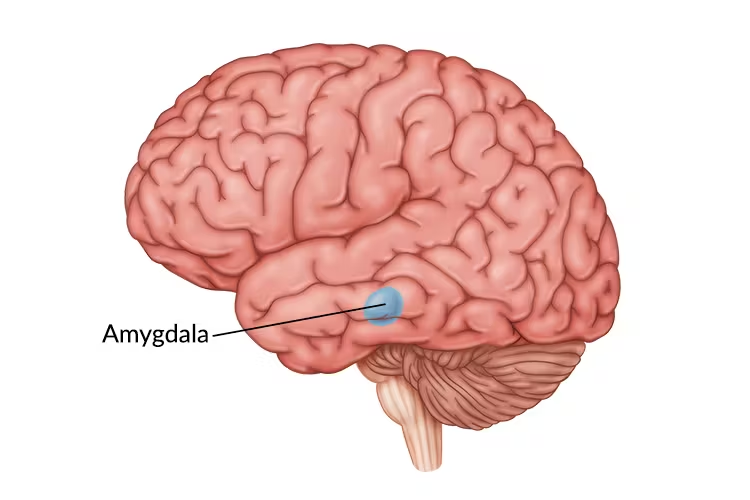

The human brain is hardwired for survival, not trading. Our amygdala, the part of the brain responsible for processing fear, perceives financial losses the same way it perceives a life-threatening danger. This is why many traders panic-sell at the bottom and FOMO-buy at the top.

Take Jesse Livermore, one of the greatest traders of all time. He made and lost fortunes multiple times in his career. Despite having one of the sharpest analytical minds, he struggled with self-sabotaging behaviors, proving that intelligence alone is not enough. Emotional control is the key to long-term success.

Rewiring the Brain for Trading Success

Professional traders don’t eliminate emotions—they train their brains to respond to market movements rationally. This involves a combination of cognitive reappraisal, neuroplasticity, and behavioral conditioning.

1. Mastering Cognitive Reappraisal

Cognitive reappraisal is the psychological technique of reframing negative events to reduce emotional impact. When a trade moves against them, amateur traders feel despair, while professionals see it as data.

- Example: Paul Tudor Jones, one of the most successful hedge fund managers, embraces losses as “tuition fees” for learning. Instead of reacting emotionally, he analyzes mistakes objectively and moves forward.

2. The Power of Process Over Outcome

A professional trader does not measure success by individual trades but by adherence to a system. This is based on the "Locus of Control" theory, which states that successful individuals focus on what they can control (risk management, execution, discipline) rather than external factors (market volatility, news events).

- Example: Ray Dalio, founder of Bridgewater Associates, emphasizes that failures should not be feared but analyzed through a systematic process. His "Principles" framework ensures that every loss becomes a lesson, reducing emotional turmoil.

3. Building Mental Toughness Through Exposure Therapy

The concept of exposure therapy in psychology states that repeated exposure to stressors in controlled settings reduces their emotional impact. Traders can train their nervous system by simulating market stress through:

- Paper trading under pressure – Placing simulated trades with a strict profit/loss rule.

- Small-stakes live trading – Developing resilience with real money but with minimal risk.

- Mindfulness & meditation – Used by hedge fund managers like Ray Dalio to stay emotionally detached from market swings.

Final Thought: The Mindset Shift That Changes Everything

Becoming a professional trader isn’t just about strategies—it’s about mastering your mind. By reframing fear, focusing on process over outcome, and training emotional resilience, you create an unbreakable trading mindset. Success in trading is not about avoiding losses—it’s about how you respond to them.