How to Reprogram Your Brain for Consistent Crypto Trading Profits

The cryptocurrency market is unlike any other financial environment—its volatility is both a source of immense opportunity and a psychological battlefield. Many traders enter the market with excitement, only to experience the emotional rollercoaster that leads to inconsistent results. Why do some traders thrive while others burn out? The difference lies not in their technical knowledge but in their cognitive conditioning. The key to long-term success is rewiring your brain to operate in a way that aligns with profitable decision-making rather than emotional reactions.

The Science Behind Trading Psychology

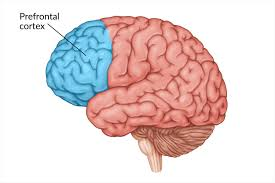

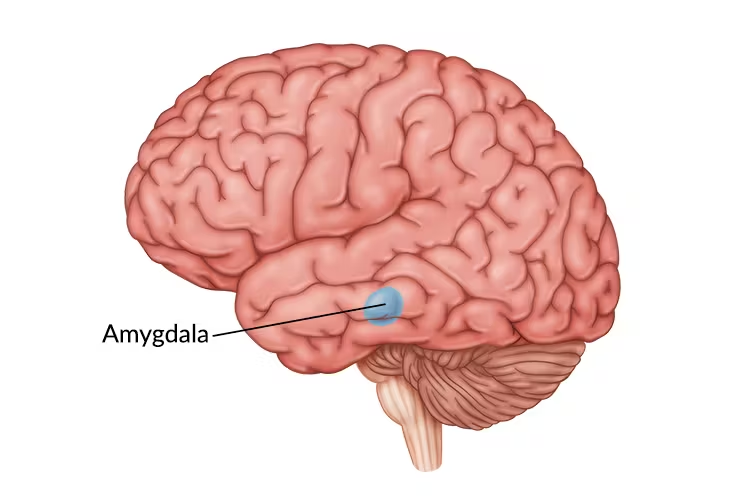

At the heart of trading psychology lies the prefrontal cortex, responsible for rational decision-making, and the amygdala, which controls emotional responses. When traders face extreme price swings, the amygdala triggers a fight-or-flight response, causing impulsive actions—panic selling during crashes or fear-of-missing-out (FOMO) buying during pumps. Successful traders, however, have trained their prefrontal cortex to override these instinctive reactions, allowing them to remain calm and execute strategic trades based on probabilities rather than emotions.

This process, known as neuroplasticity, is the brain’s ability to rewire itself based on repeated behaviors. By consistently applying cognitive reprogramming techniques, traders can train their brains to operate in a disciplined, structured manner, even in high-risk environments.

Building a Resilient Trading Mindset

1. Exposure Therapy: Desensitizing Yourself to Volatility

One of the most effective psychological techniques used by elite traders is exposure therapy, a concept borrowed from clinical psychology. The idea is simple: repeated exposure to market volatility reduces the emotional impact over time.

Consider hedge fund trader Paul Tudor Jones, known for his ability to remain calm under extreme market stress. Instead of avoiding volatile conditions, he intentionally exposed himself to chaotic market situations, training his brain to process uncertainty without emotional interference.

Traders can replicate this by backtesting historical crypto price movements and simulating trades in highly volatile conditions. By gradually increasing their exposure to risk, they develop emotional resilience—a trait that separates professionals from amateurs.

2. Cognitive Reframing: Changing the Perception of Losses

Loss aversion—the psychological tendency to feel losses more intensely than equivalent gains—is a major roadblock for traders. This bias, identified in prospect theory by psychologists Daniel Kahneman and Amos Tversky, causes traders to hesitate, close winning trades too early, and hold onto losing trades in denial.

To overcome this, traders must practice cognitive reframing—consciously changing their interpretation of losses. Instead of viewing losses as failures, top traders see them as the cost of doing business. For instance, billionaire investor Ray Dalio treats every loss as valuable feedback, refining his strategy after each mistake.

A practical approach to this is keeping a trading journal that logs every loss, not with self-criticism but with objective analysis. By consistently identifying patterns and learning from mistakes, traders can shift their mindset from fear-based reactions to systematic growth.

3. Mindfulness & Pre-Trading Rituals

High-performance athletes and top traders share a common habit: pre-performance routines that prime their minds for peak focus. UFC fighters use meditation before stepping into the octagon, and elite traders use mindfulness techniques to detach from impulsive emotions.

A famous example is Steve Cohen, a legendary hedge fund manager who meditates daily to enhance his trading precision. Neuroscientific studies confirm that meditation increases gray matter density in the prefrontal cortex, improving decision-making under stress.

Traders can implement a pre-trading ritual that includes:

- Deep breathing exercises (activates the parasympathetic nervous system, reducing stress).

- Visualization of potential scenarios (prepares the mind for different market outcomes).

- Writing down execution rules (reinforces discipline before entering a trade).

This routine ensures that every trade is approached logically, rather than emotionally.

Conclusion: Mastering the Mental Edge

Crypto trading success is not about predicting the market but about mastering one’s own psychology. By using exposure therapy to desensitize emotions, cognitive reframing to remove loss aversion, and mindfulness techniques to maintain composure, traders can rewire their brains for long-term profitability.

The ability to stay rational in irrational markets is what separates consistent winners from the rest. By embracing these psychological techniques, traders can develop a mindset that not only survives volatility but thrives in it.