How to Spot a Memecoin Scam - The Real Way to Check a Memecoin’s Safety

How to Identify Memecoin Scams with 100% Accuracy: A Comprehensive Guide

The meteoric rise of memecoins—cryptocurrencies inspired by internet memes and pop culture—has captivated the attention of investors worldwide. While some have reaped substantial profits, others have fallen victim to scams that exploit the hype surrounding these digital assets. Identifying memecoin scams with absolute certainty is challenging due to their evolving nature. However, by understanding common fraudulent tactics, analyzing real-life cases, and utilizing available tools, investors can significantly reduce their risk exposure.

Understanding Memecoin Scams

Memecoin scams typically manifest in several forms:

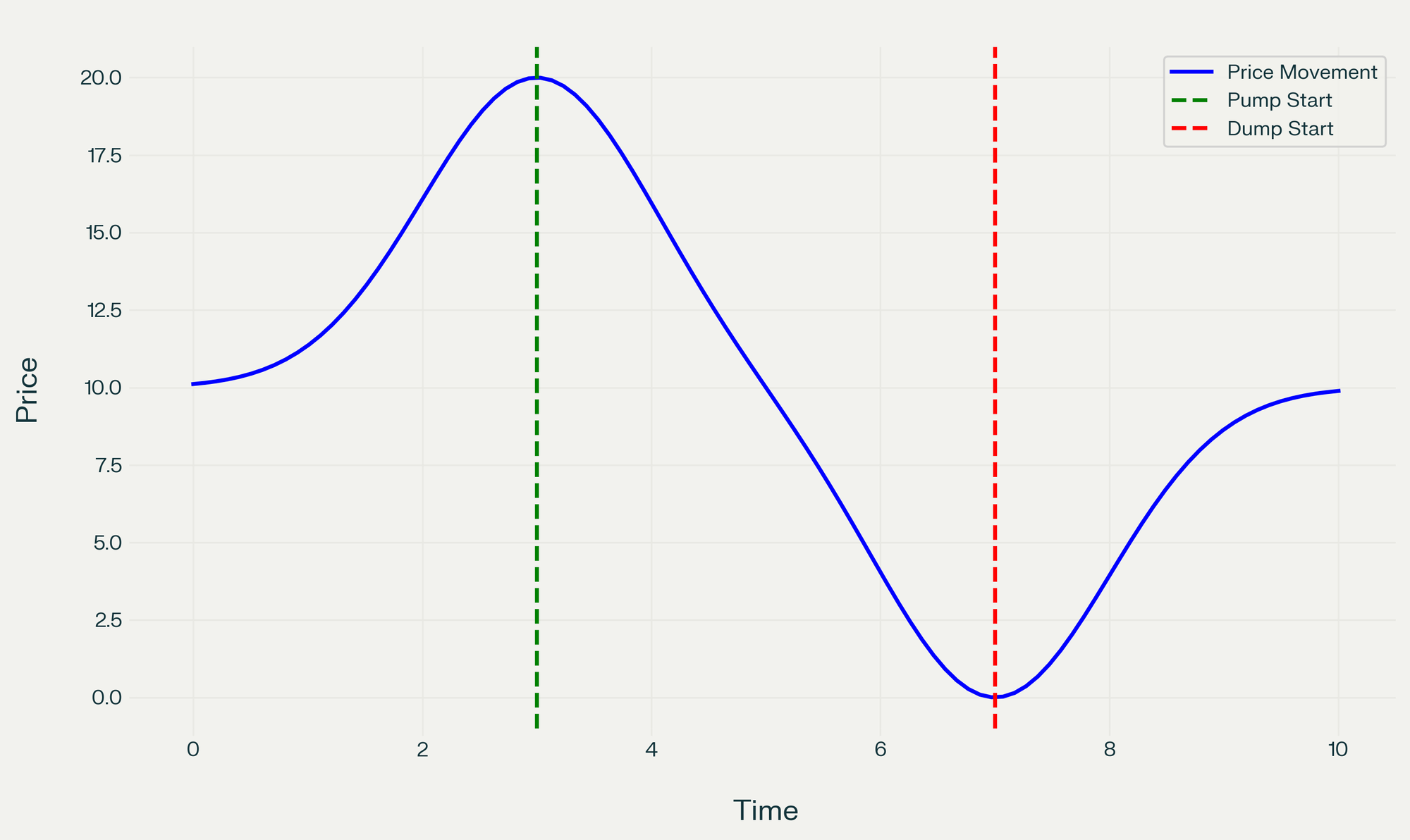

- Pump-and-Dump Schemes: Coordinated efforts artificially inflate a token's price through misleading promotions, only for insiders to sell off their holdings at the peak, causing the price to plummet.

- Honeypots: Smart contracts are designed to allow purchases but prevent sales, trapping investors' funds.

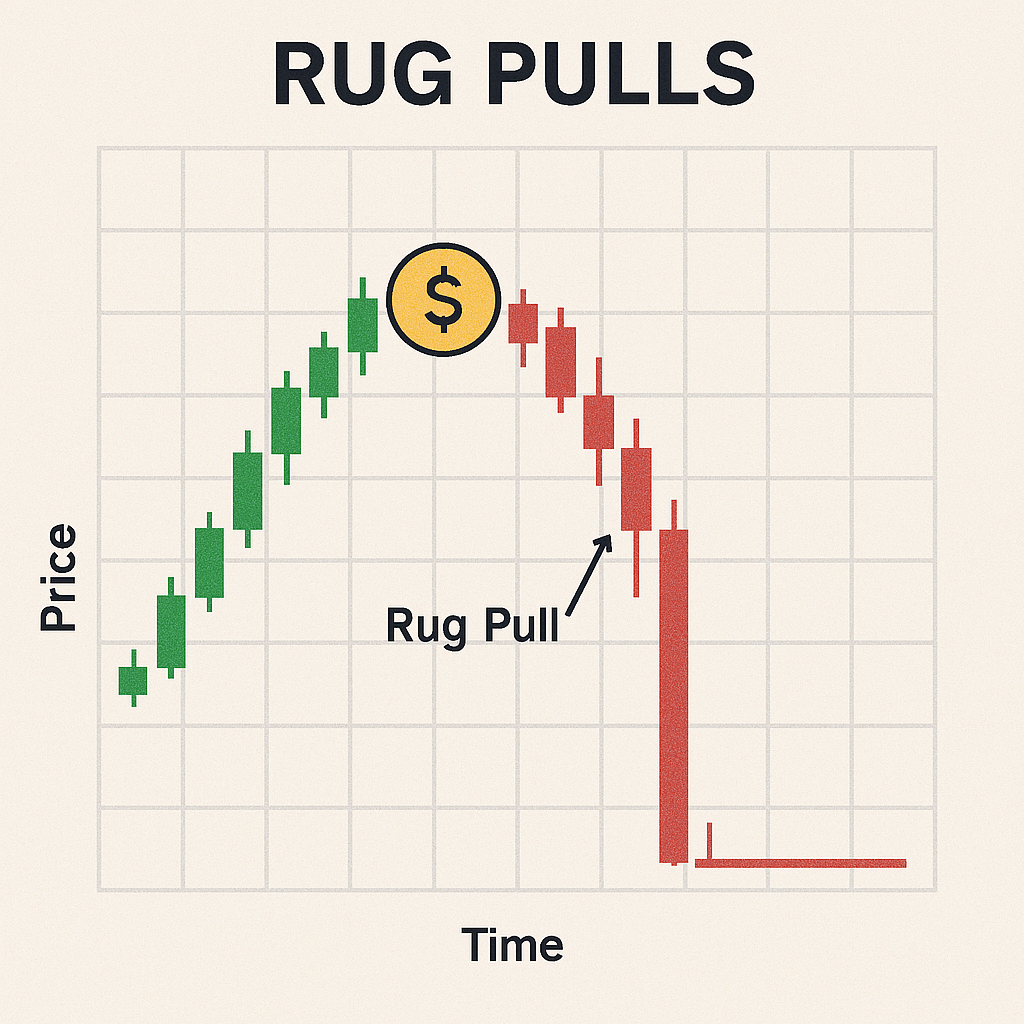

- Rug Pulls: Developers abruptly withdraw all funds from a project, leaving investors with worthless tokens. This is the most prevalent scam in the memecoin space.

Real-Life Examples of Memecoin Scams

Examining past incidents provides valuable insights into the tactics employed by scammers:

Squid Game Token (SQUID): Capitalizing on the popular Netflix series, developers launched SQUID, which saw its price soar before implementing an anti-sell mechanism, preventing investors from selling their tokens. The developers then vanished with approximately $3.3 million.

- Mutant Ape Planet (MAP) NFTs: Mimicking the successful Mutant Ape Yacht Club, this project lured investors before the developer absconded with $2.9 million, leaving buyers with worthless NFTs.

- Hawk Tuah ($HAWK) Token: Launched by internet personality Haliey Welch in December 2024, the token's value skyrocketed to a market capitalization of nearly $500 million before plummeting to $25 million amid allegations of a pump-and-dump scheme and insider trading.

Key Indicators of Potential Memecoin Scams

To safeguard investments, it's crucial to recognize red flags associated with fraudulent memecoins:

- Anonymous or Unverified Developers: Legitimate projects typically have transparent teams with verifiable backgrounds. Anonymity can indicate a lack of accountability.

- Lack of Clear Use Case or Whitepaper: Genuine projects provide detailed documentation outlining their purpose and technology. The absence of such information is a warning sign.

- Unrealistic Promises of High Returns: Guarantees of substantial profits with minimal risk are common tactics used to lure unsuspecting investors.

- Poorly Written or Unverifiable Smart Contracts: Malicious code can enable developers to manipulate token functions, such as restricting sales or minting additional tokens.

- No Locked Liquidity: Locked liquidity ensures that developers cannot withdraw funds immediately after launch. The absence of liquidity locks increases the risk of rug pulls.

- Excessive Developer Control: Contracts that allow developers to modify fees, halt trading, or blacklist addresses can be exploited for fraudulent purposes.

Tools and Strategies for Detecting Memecoin Scams

Leveraging specialized tools can enhance the ability to identify potential scams:

- DEXTools and DEXscreener: Platforms that provide real-time data on token performance and flag issues like unlocked liquidity or suspicious contract functions.

- TokenSniffer: Analyzes smart contracts for known scams, vulnerabilities, and other red flags, assigning a risk score to the token.

- Social Media Analysis: Investigating a project's presence on platforms like Twitter, Reddit, and Telegram can reveal community sentiment and potential concerns.

The Role of Machine Learning in Scam Detection

Recent studies have explored the application of machine learning models to predict memecoin scams. For instance, research utilizing logistic regression, random forest, and support vector machine techniques achieved approximately 70% accuracy in identifying fraudulent tokens based on characteristics such as developer anonymity, token distribution, and liquidity metrics.

Conclusion

While achieving 100% accuracy in detecting memecoin scams is unattainable due to the dynamic and sophisticated nature of fraudulent schemes, a combination of thorough research, vigilance, and the use of analytical tools can significantly mitigate risks. Investors should prioritize transparency, scrutinize project fundamentals, and remain cautious of red flags to navigate the memecoin market safely.

References

- Securities.io. "5 'Worst' Rug-Pulls in Crypto." April 2025.

- DappRadar. "How to Find Memecoins Early and Make Sure They Aren't Scams."

- Whistleblowers International. "Meme Coin Scams: How to Spot and Avoid Them."

- Hodgesscholars. "Application of Machine Learning for Meme Coin Scam Detection."

- Wikipedia. "Haliey Welch."