$LIBRA Pump & Dump? Insiders Pulled $87M From Liquidity!

Key Takeaways

- Argentina's President Javier Milei promoted the $LIBRA token, which experienced a meteoric rise to a $4.5 billion market cap before crashing by 89%.

- The token's collapse has raised concerns about centralized control and potential fraudulent activities within the project.

The $LIBRA Token Rollercoaster: From Presidential Endorsement to Market Plunge

In a surprising move, Argentine President Javier Milei took to his official X (formerly Twitter) account to endorse a new cryptocurrency token named $LIBRA. Marketed as a private initiative aimed at stimulating Argentina's economy by funding small businesses and startups, the token quickly garnered massive attention. Within hours of the announcement, $LIBRA's market capitalization soared to an impressive $4.5 billion, with the token's price peaking at $4.50.cryptobriefing.com

However, the euphoria was short-lived. Amid growing skepticism over the token's legitimacy and concerns about potential pump-and-dump schemes, $LIBRA's value plummeted by approximately 89%, settling at just $0.50. This dramatic downturn left investors and the broader crypto community questioning the token's authenticity and the motives behind its rapid rise and fall.cryptobriefing.com

Centralization Concerns and Potential Fraudulent Activities

Further investigation into $LIBRA's structure unveiled alarming details. Blockchain analytics firm Chainalysis identified several red flags, including the concentration of a significant portion of the token's supply in a single wallet. This centralization suggests potential manipulation and raises questions about the project's transparency and governance.cryptobriefing.com

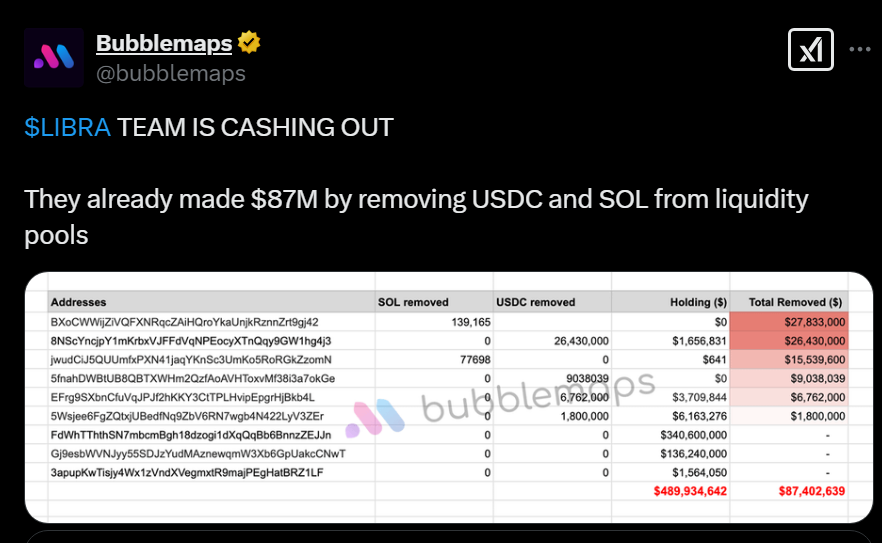

Adding to the controversy, on-chain data visualization startup Bubblemaps reported that the development team behind $LIBRA had withdrawn $87 million from liquidity pools. This action indicates that insiders may have profited substantially during the token's brief surge, further undermining investor confidence.cryptobriefing.com

Historical Precedents: Learning from Similar Scenarios

The $LIBRA incident is reminiscent of previous cases where political figures have been linked to cryptocurrency launches with dubious outcomes. Notably, in late 2021, President Milei promoted CoinX, an alleged crypto Ponzi scheme, on Instagram, claiming it could help Argentinians combat inflation. Investors reported significant losses, leading to legal actions and a tarnished reputation for those involved.cryptobriefing.com

Implications for Investors: Navigating the Crypto Landscape

The rapid rise and fall of $LIBRA underscore the volatile nature of the cryptocurrency market and highlight the risks associated with tokens lacking transparency and decentralized control. For investors, this incident serves as a cautionary tale:

- Due Diligence is Crucial: Before investing, thoroughly research the project's fundamentals, including its leadership, token distribution, and underlying technology.

- Beware of Centralized Control: Tokens heavily controlled by a single entity or wallet pose significant risks of manipulation.

- Skepticism Towards Political Endorsements: Political figures endorsing cryptocurrencies may not always have the expertise or genuine intent, and such endorsements can be misleading.

Looking Ahead: The Long-Term Perspective

While the $LIBRA debacle has undoubtedly shaken investor confidence, it also offers valuable lessons for the crypto community. Emphasizing transparency, decentralization, and robust governance can help in building trust and fostering a more resilient cryptocurrency ecosystem. As the market matures, investors are encouraged to approach new projects with caution, prioritize due diligence, and remain informed about potential risks.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in cryptocurrencies carries inherent risks, and it's essential to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.