The Psychology of Dumb Money: How Emotional Traders Create Opportunity

In every financial market—stocks, forex, crypto—there’s a group of traders referred to as “dumb money.” This term isn’t meant to insult anyone’s intelligence, but to describe a predictable pattern of emotional behavior that tends to work against those who follow it. These traders often make decisions based on hype, fear, and the crowd, rather than data, strategy, or discipline. And while they’re reacting emotionally, another group—known as “smart money”—is quietly profiting from those very reactions.

So, what exactly drives dumb money behavior? And more importantly, how can you take advantage of it instead of falling into its trap?

Following the Crowd: The First Mistake

Dumb money typically chases the crowd. When prices are rising and everyone on social media is celebrating profits, dumb money jumps in. This behavior is driven by a powerful psychological force called herd mentality—the idea that if everyone else is doing something, it must be safe or profitable.

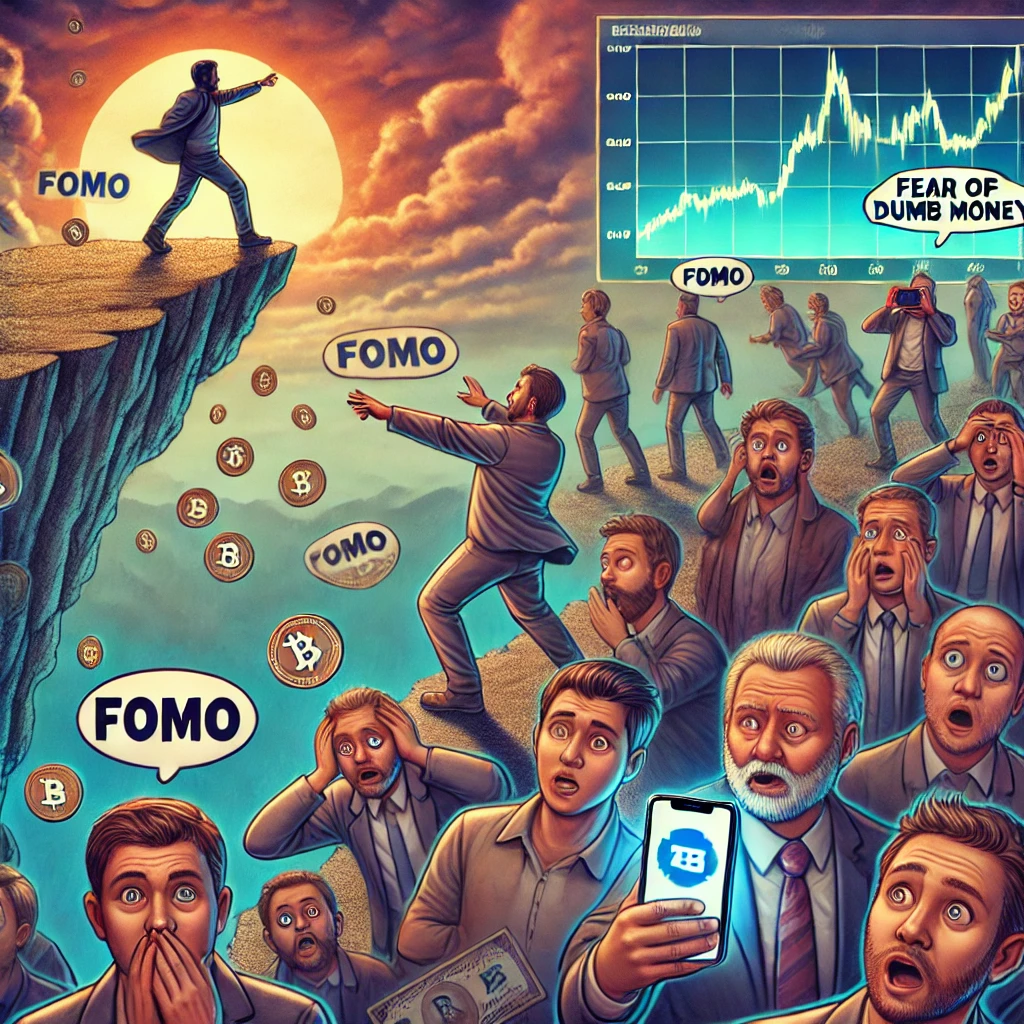

Imagine a coin like SHIB or DOGE suddenly trending on Twitter, getting covered by major news outlets, and discussed in every Telegram group. Prices start climbing fast. Most retail traders, seeing others get rich, begin to experience FOMO (Fear of Missing Out). They enter late—often near the top—fueled by emotion, not analysis.

This behavior creates liquidity, allowing smart traders who bought early to sell their positions at high prices. The dumb money is unknowingly buying into someone else's profits.

Reacting to Losses: The Second Mistake

After entering high, many dumb money traders don’t use stop-losses or risk management. When the inevitable pullback happens, they freeze. They don’t want to sell at a loss, hoping the price will bounce back. This is called loss aversion, where the emotional pain of losing money causes irrational decision-making.

But when the losses deepen, panic sets in. And because they didn’t have a plan to begin with, they finally sell—right near the bottom—locking in the worst possible outcome.

This is the same cycle that repeats over and over: FOMO buying at the top, emotional selling at the bottom.

How Smart Money Exploits Dumb Money Behavior

Smart money operates differently. These traders and investors understand crowd psychology and use it as a sentiment indicator. When they see hype, they prepare to exit. When they see fear, they prepare to buy.

Let’s take a real-life example: During the 2021 bull run, Bitcoin and altcoins hit record highs. Retail interest exploded. YouTube was flooded with predictions like “$100K BTC in weeks.” Search trends hit all-time highs. To the trained eye, this was not a buy signal—it was a sell signal. Smart money used the retail excitement to distribute their holdings quietly into the frenzy.

Later, during the bear market, when everyone was calling crypto a scam and portfolios were down 70–90%, smart money began accumulating again—calmly, while everyone else was panicking.

The Core Psychological Difference

At the heart of it, dumb money trades emotionally, while smart money trades strategically. Dumb money responds to the present (e.g., “Price is going up, I should buy”), while smart money anticipates the future (e.g., “Price has gone up too fast; sentiment is overheated; I should prepare to exit”).

Smart traders treat trading like a business. They plan entries and exits, use stop-losses, protect capital, and detach emotionally from individual trades. Dumb money, in contrast, often treats trading like gambling—riding hope, hype, and gut feeling.

Conclusion: From Dumb Money to Smart Money

The key takeaway isn’t to judge others—but to recognize that we all start as emotional traders. The real goal is to evolve your mindset, to understand the traps that dumb money falls into, and to rise above them with structure, discipline, and self-awareness.

Once you start seeing how predictable emotional behavior moves the market, you begin to understand the real edge in trading: not in predicting the price, but in anticipating how others will react to it.

And when you can do that, you’re no longer the dumb money. You’re trading like smart money—calm, strategic, and consistently profitable.