Top Chinese Crypto Coins: How Blockchain Growth and Regulation Shifts Could Drive the Next Investment Wave

China is quietly becoming a crypto powerhouse, despite its restrictions on Bitcoin trading. With groundbreaking blockchain projects, strategic government backing, and Hong Kong’s pro-crypto stance, savvy investors are looking East for the next big opportunity.

Could these developments be your ticket to early gains? Recent headlines show a surge in blockchain investment and adoption across Chinese markets—could this signal the next wave in global crypto?

Key TakeAway:

- China’s Blockchain Growth:

- The Chinese blockchain industry is expected to grow by 54.6% annually, surpassing the global average of 48%.

- Government-backed projects and private investments have fueled $2.5 billion in crypto-related developments.

- Top Chinese Crypto Projects to Watch:

- NEO (Chinese Ethereum): Focused on smart contracts with compliance-friendly features and strategic adoption by major corporations.

- VeChain: Revolutionizing supply chain management with partnerships like Walmart and BMW.

- Conflux: China’s homegrown blockchain, balancing scalability and decentralization.

- Shifting Regulatory Landscape:

- Hong Kong’s crypto-friendly regulations aim to establish the region as a global hub.

- Beijing’s Web3 Innovation Fund pledges $14 million annually for blockchain advancements, signaling potential future adoption.

- Real-World Applications:

- Blockchain tech is being implemented in logistics, healthcare, public services, and manufacturing.

- Companies like Tencent and Alibaba are leveraging decentralized systems to improve efficiency.

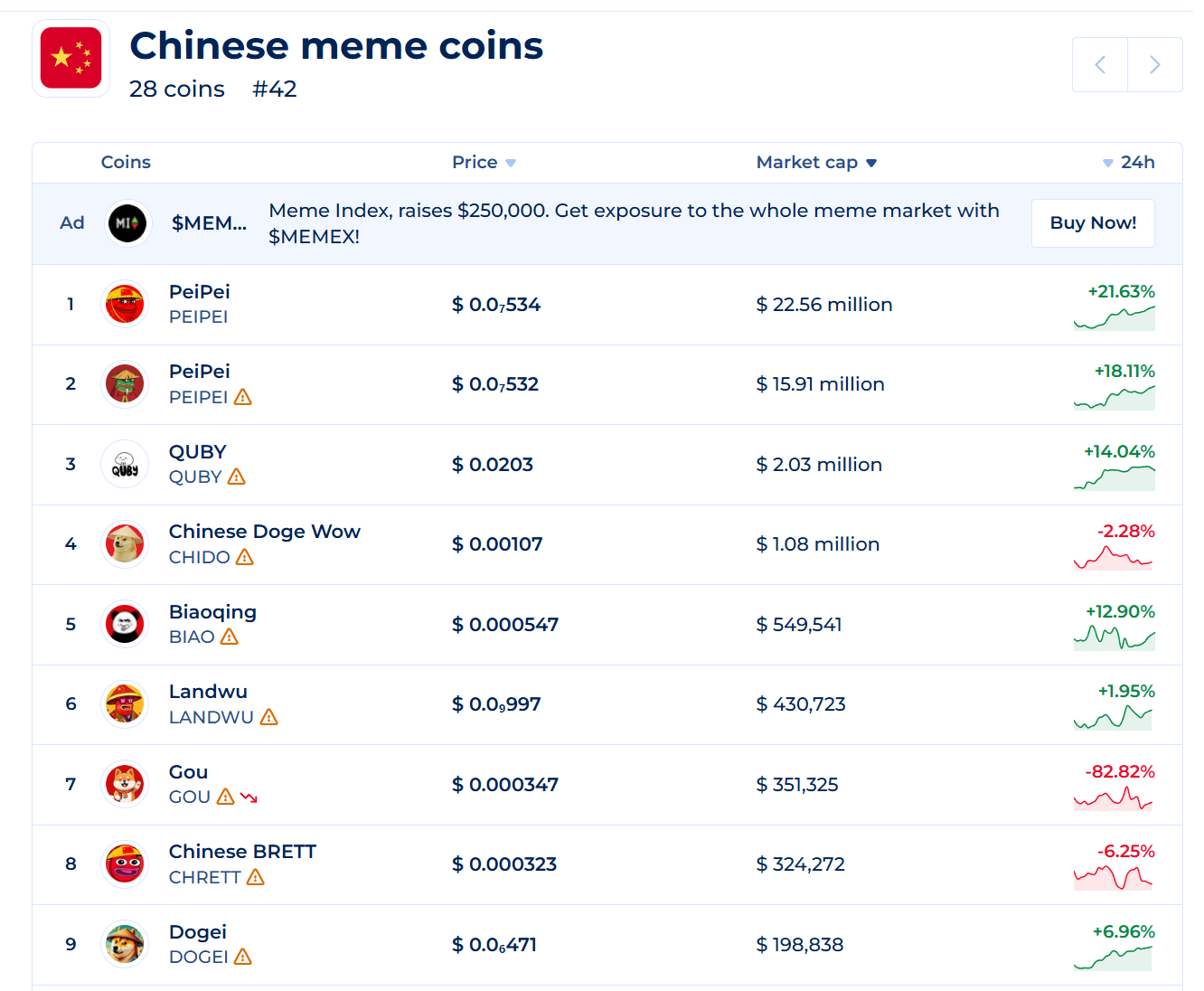

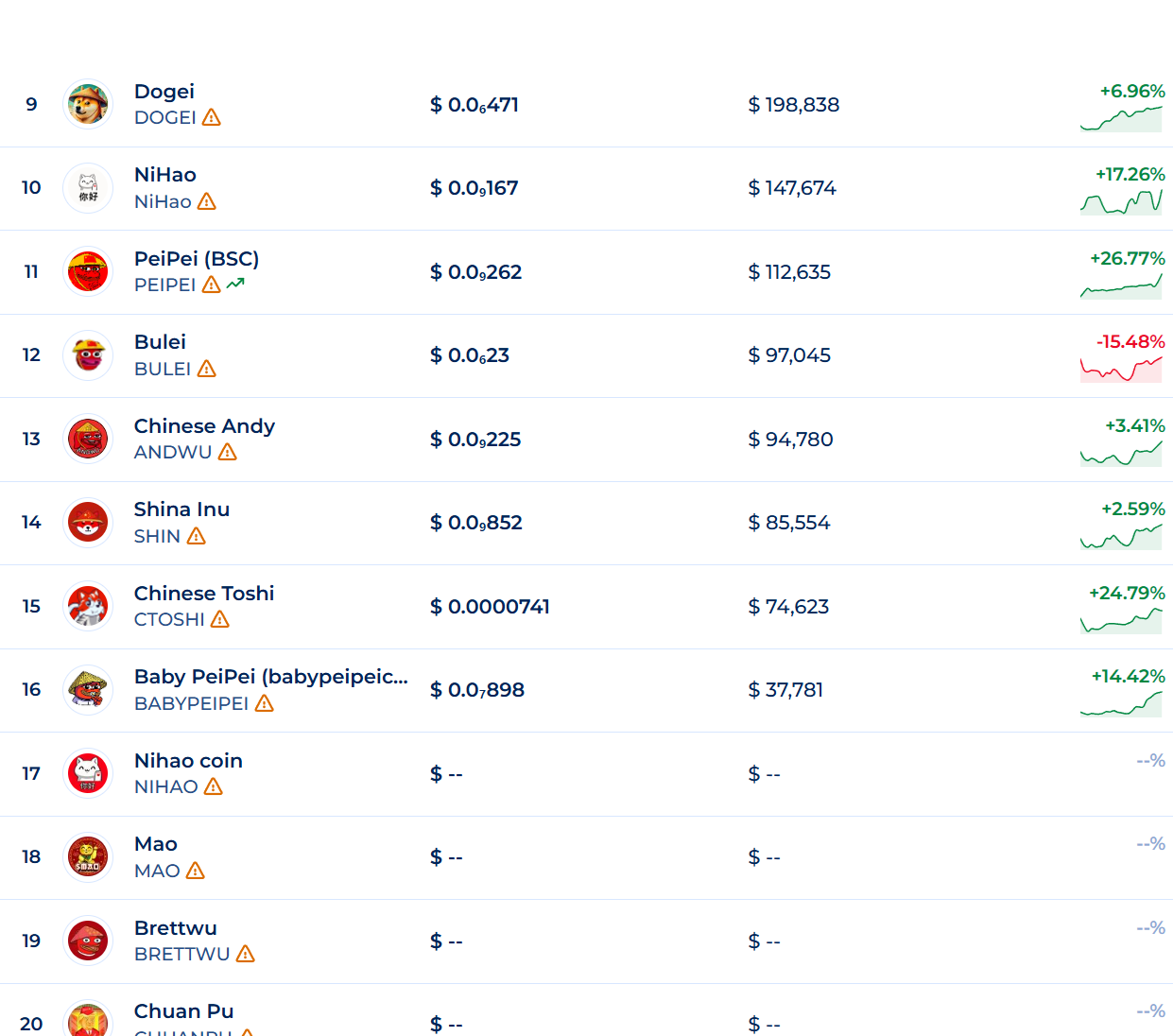

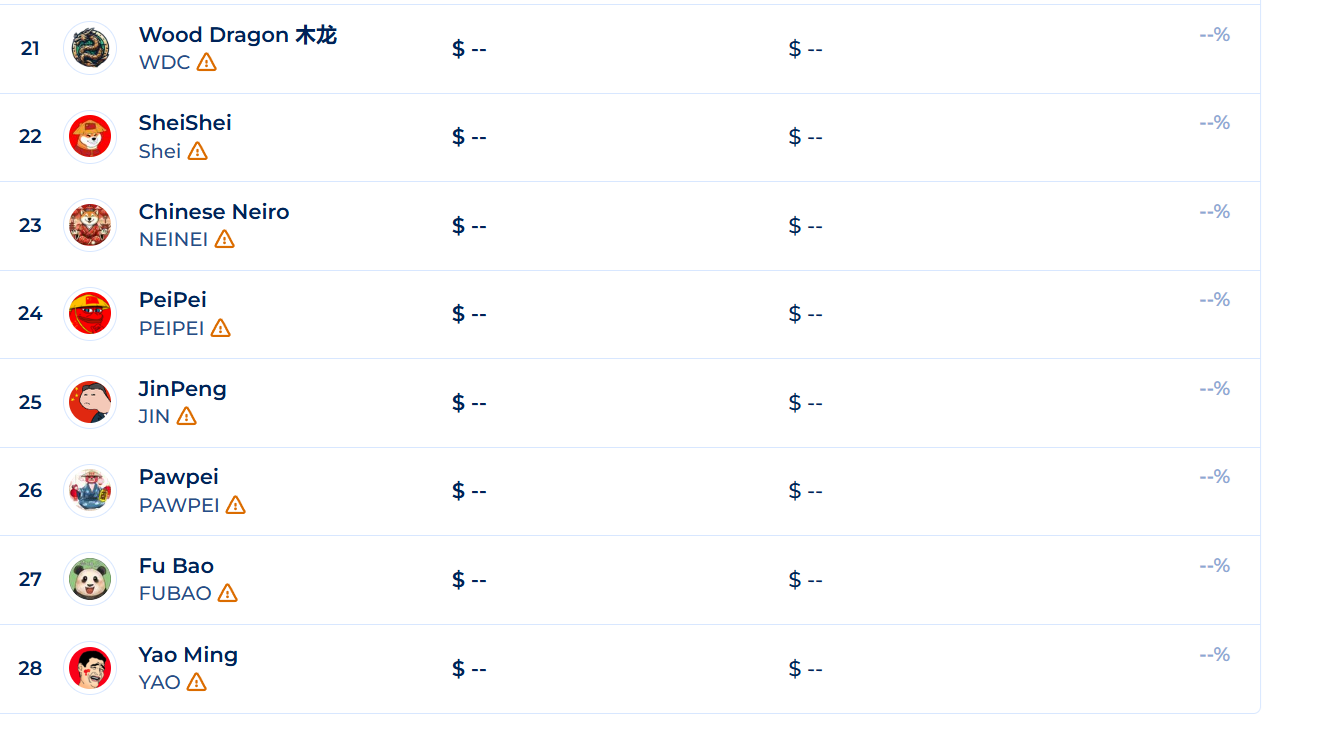

Chinese Top 28 MeMe Coins List 2025

In 2017, China imposed a sweeping ban on crypto trading, sending shockwaves through the global market. However, as the country pivots toward embracing blockchain technology for practical applications in sectors like logistics and healthcare, the crypto landscape in China is evolving.

Major corporations such as Tencent and Huawei have integrated decentralized systems, signaling a shift in China’s approach to crypto. Additionally, China's aggressive push for blockchain development is showcased in the Web3 Innovation Fund, which pledges $14 million annually to foster blockchain research and development.

Current Developments

- NEO: Positioned as the "Chinese Ethereum," NEO aims to streamline enterprise blockchain adoption with compliance-friendly features that meet both Chinese regulatory requirements and global business standards. In recent news, NEO's growing adoption by Agricultural Bank of China and BYD signals its increasing presence in China’s corporate sector.

- VeChain: VeChain’s partnerships with Walmart, BMW, and PwC have been pivotal in revolutionizing supply chain management. In 2023, Walmart China announced that it would use VeChain's blockchain for tracking pork and wine products from farm to fork—an indication of blockchain's growing role in supply chain transparency.

- Conflux: Known as China's homegrown blockchain darling, Conflux boasts scalability and decentralization with its unique consensus mechanism, Tree-Graph. Recent reports show Conflux's integration with China’s largest public blockchain pilot program for government-backed use cases in smart cities and digital asset management.

For investors, China presents a unique opportunity to tap into a blockchain ecosystem with significant real-world applications and government support.

- For Developers: China’s developer-friendly regulations provide fertile ground for innovation, with blockchain frameworks like NEO and Conflux gaining recognition for their robust infrastructure and scalability.

- For Investors: Projects such as VeChain are leading blockchain solutions in supply chain management and business integration. Their large-scale corporate partnerships and government backing signal strong long-term growth potential.

- For Global Markets: Hong Kong’s push for crypto-friendly regulations suggests China’s broader adoption of blockchain could accelerate—turning previously restrictive policies into proactive growth initiatives.

Market Position and Data-Driven Insights

- NEO: With a market cap of $780 million, NEO is actively expanding its global influence, with major Chinese corporations incorporating blockchain solutions.

- VeChain: $VET has a $2.5 billion market cap and strong daily trading volume, largely driven by its real-world applications in supply chain management.

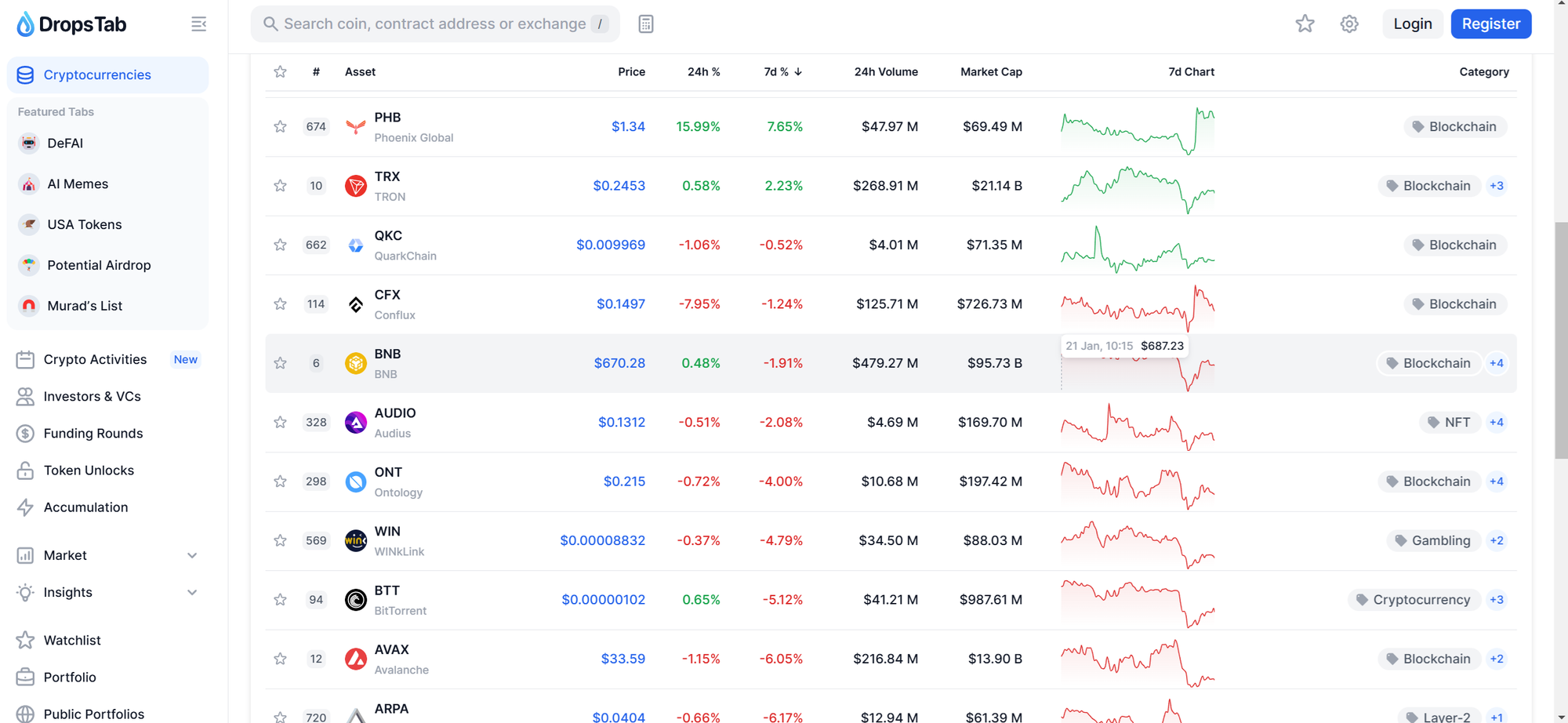

- Conflux: $CFX's market cap exceeds $750 million, with daily trading volumes hovering above $55 million, showcasing significant institutional interest.

Sample Market Data (2025)

- NEO: $780 million market cap, 12% growth in Q1 2025.

- VeChain: $2.5 billion market cap, large institutional interest.

- Conflux: $750 million market cap, growing adoption for smart city initiatives.

Analysis

Upsides:

- China’s blockchain projects like VeChain and Conflux offer real-world utility, strategic partnerships, and government backing—key ingredients for long-term investment success.

- NEO’s compliance with Chinese regulations and its focus on enterprise adoption make it an attractive investment for businesses looking to integrate blockchain.

Risks:

- China’s fluctuating regulatory environment remains a challenge. While blockchain is embraced, policies around decentralized cryptocurrencies are still uncertain.

- Potential volatility due to ongoing market adjustments and the global economic landscape.

My Thought

As someone who’s followed the progression of blockchain adoption in China, I’ve witnessed the country’s efforts to embrace innovation while navigating regulatory hurdles. Investing in VeChain in 2020, I saw firsthand how strong partnerships and real-world use cases set it apart from other projects. With China’s increasing openness to blockchain and Hong Kong’s regulatory overhaul, I’m now even more optimistic about the future growth of these projects.

Final Thoughts

With China's increasing adoption of blockchain technologies and Hong Kong's emerging regulatory framework, now is a critical time for investors to explore opportunities in NEO, VeChain, and Conflux. These projects stand at the intersection of innovation, compliance, and government support—positioning them for long-term success. As the Chinese government accelerates blockchain implementation across industries, the country’s growing blockchain landscape could offer significant returns for those who act now.