What Is a Crypto White Paper - With Example

What Is a Crypto White Paper and Why It’s Crucial for Every Investor (2025 Guide)

In the world of cryptocurrency and blockchain technology, one document can make or break a project: the white paper. Whether you're an investor, developer, or crypto enthusiast, understanding what a white paper is — and how to analyze one — is essential for making informed decisions.

In this guide, we’ll cover:

- What a crypto white paper is

- Why it's important in the crypto ecosystem

- Key components of a strong white paper

- How to evaluate one before investing

- Red flags to watch for

Let’s dive into everything you need to know about white papers in the crypto space.

What Is a White Paper in Cryptocurrency?

A white paper in crypto is a comprehensive document that explains a blockchain or crypto project in detail. It outlines the problem the project aims to solve, the proposed solution, the technology stack, tokenomics, and the project roadmap.

It’s not just a technical explanation — a white paper is the project’s blueprint, business plan, and pitch deck all in one.

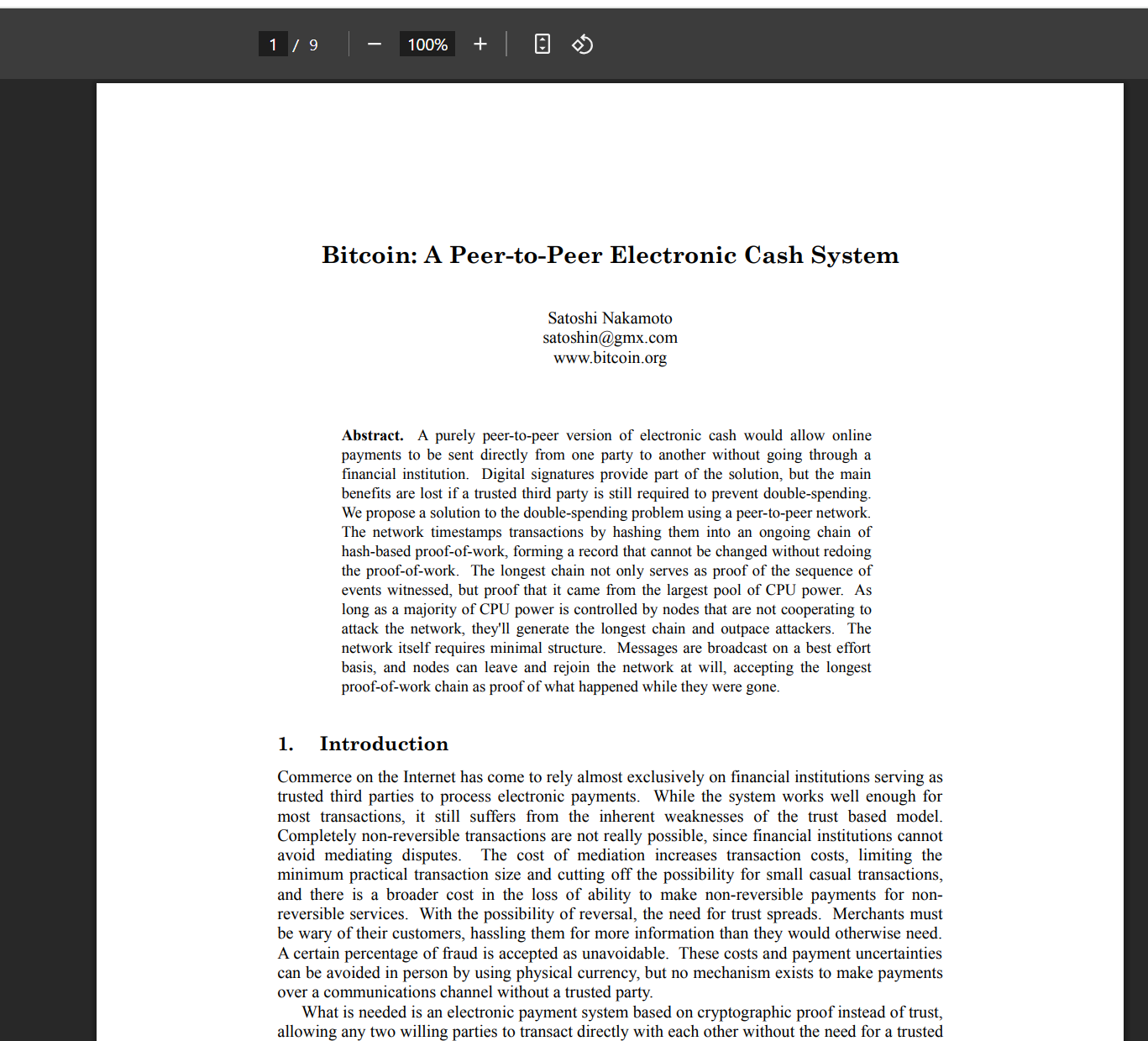

Below is the original bitcoin white paper.source

Why White Papers Matter in Crypto

1. Establishes Trust and Credibility

In an industry with minimal regulation, a detailed white paper signals transparency and professionalism. It helps investors identify whether the project is legitimate or potentially a scam.

2. Communicates Purpose and Vision

The white paper outlines what problem the project is solving, why it matters, and how blockchain technology is being used to address it. This clarity helps build alignment with the target audience.

3. Explains the Technology

A good white paper dives deep into how the system works — from consensus mechanisms and smart contracts to scalability solutions and data privacy protocols.

4. Details the Tokenomics

One of the most important sections, tokenomics covers how the native token works, how it will be distributed, its utility, and how it supports the project’s economy. Weak tokenomics often lead to project failure.

5. Lays Out the Roadmap

A clear roadmap builds investor confidence and allows the community to hold the team accountable. It shows the project’s development stages, key milestones, and timelines.

6. Attracts Community and Developer Interest

Crypto projects thrive on community support. A compelling white paper can attract early adopters, partners, contributors, and developers who believe in the mission.

7. Minimizes Legal Risks

Many teams include legal disclaimers and token classifications in the white paper to reduce regulatory risks and provide legal clarity.

Common Sections of a Crypto White Paper

While each project may format its white paper differently, here are the most common sections to expect:

Abstract

A summary of the project, its goals, and how it works.

Introduction

Provides context on the industry problem and why it’s worth solving.

Problem Statement

Explains the specific issue the project addresses and why current solutions fall short.

Proposed Solution

Outlines how the project intends to solve the problem using blockchain or decentralized technology.

Technical Architecture

Covers the underlying technical design, such as consensus algorithm, infrastructure, smart contracts, scalability, and security.

Tokenomics

Describes the token’s utility, supply, distribution, incentives, and governance mechanisms.

Use Cases

Real-world applications for the token or platform — who will use it and why.

Roadmap

Development stages, feature rollouts, and future milestones.

Team

Information about the founders, developers, and advisors with links to professional profiles.

Legal Disclaimers

Statements about risks, investment warnings, and regulatory positioning.

How to Evaluate a Crypto White Paper Before Investing

Not all white papers are created equal. Here’s how to assess one effectively:

Clarity and Simplicity

Avoid documents filled with jargon or vague buzzwords. A strong white paper should be clear and understandable.

Defined Problem and Solution

Does the project solve a real problem? Is the solution innovative and realistic?

Sound Tokenomics

Is the token essential to the ecosystem, or does it exist just for fundraising? Review allocation, utility, and vesting schedules.

Experienced and Transparent Team

Check team bios and LinkedIn/GitHub profiles. Transparency matters.

Roadmap and Delivery Plan

A well-planned roadmap indicates long-term vision. Unrealistic timelines are a red flag.

Community and Ecosystem Strategy

Does the project outline how it will grow and sustain a user base? Is there a plan to attract developers or partners?

Red Flags in Crypto White Papers

Be cautious if you notice any of the following:

- Plagiarized or copied content

- Overpromising or unrealistic claims

- No identifiable team members

- Poorly defined token use

- Lack of technical detail or vague explanations

- Missing or overly ambitious roadmap

If something feels off, it probably is. Always do your own research (DYOR).

Real Examples of Famous Crypto White Papers

Bitcoin (BTC)

Satoshi Nakamoto’s 2008 white paper introduced peer-to-peer electronic cash and the blockchain structure we know today.

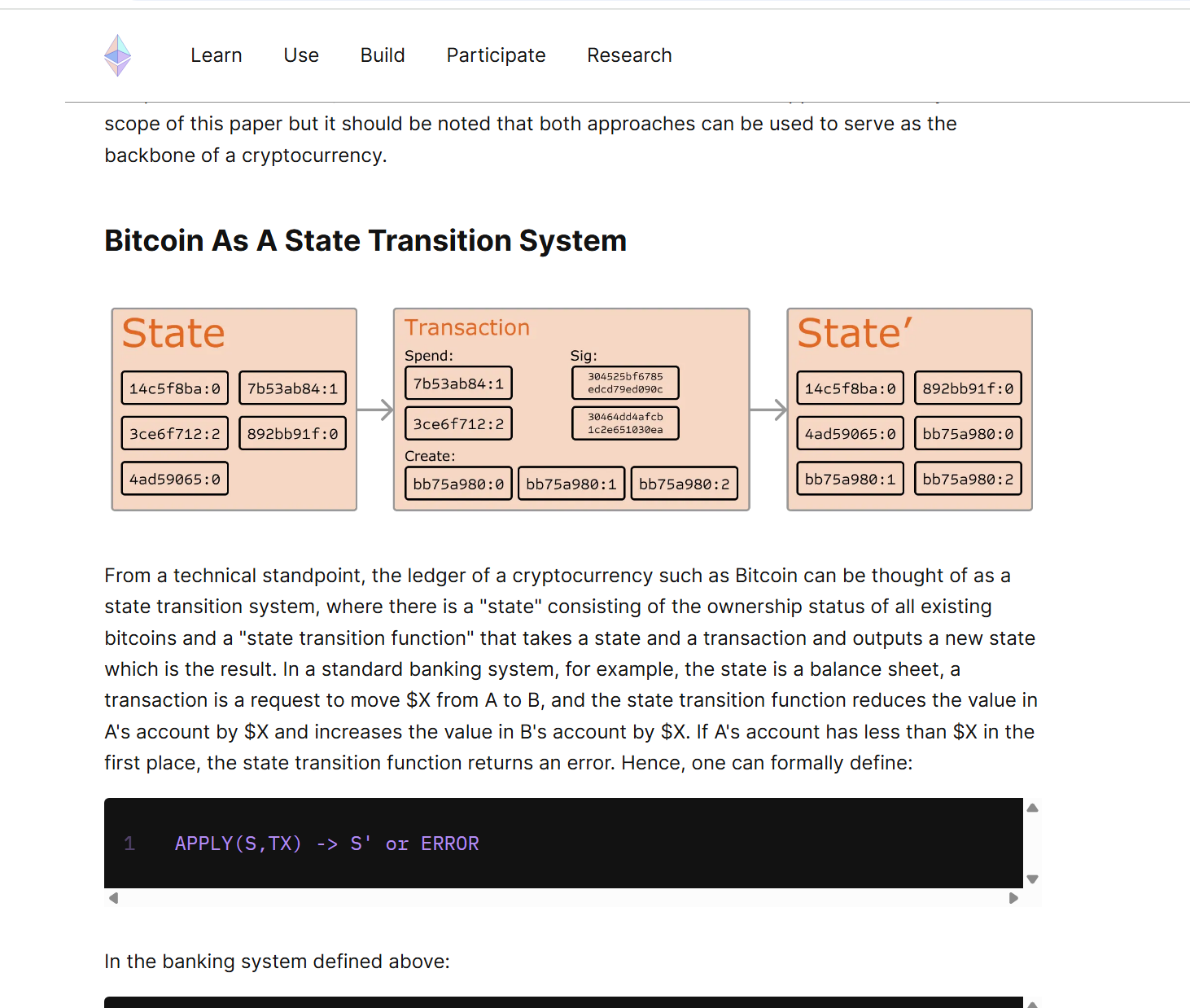

Ethereum (ETH)

- source

Vitalik Buterin’s white paper proposed a decentralized world computer and smart contracts, setting the stage for DeFi and NFTs.

Polkadot (DOT)

- source

Introduced a multi-chain ecosystem where different blockchains can interoperate securely.

Filecoin (FIL)

Explained a decentralized storage network powered by blockchain incentives and mining.

These white papers helped build trust, attract communities, and raise funding — and they continue to influence the industry.

Do White Papers Still Matter in 2025?

Yes, but expectations have evolved. In 2017, investors often funded projects based solely on a white paper. Today, the standard is much higher. A strong white paper should be backed by:

- A working prototype or minimum viable product (MVP)

- Transparent tokenomics and audits

- An engaged community

- Clear legal positioning

While a white paper is still foundational, it must be part of a larger, credible strategy to earn investor trust in 2025 and beyond.

Final Thoughts

A crypto white paper is more than a technical document — it’s the core of any serious blockchain project. It sets the tone for transparency, explains the technology, and aligns the community with the project’s goals.

Before investing, always read the white paper carefully. Ask yourself:

- Is the problem worth solving?

- Is the solution feasible and unique?

- Does the token have real value?

- Is the team credible?

With the right questions and a clear understanding, you can use white papers to identify high-potential projects — and avoid costly mistakes.