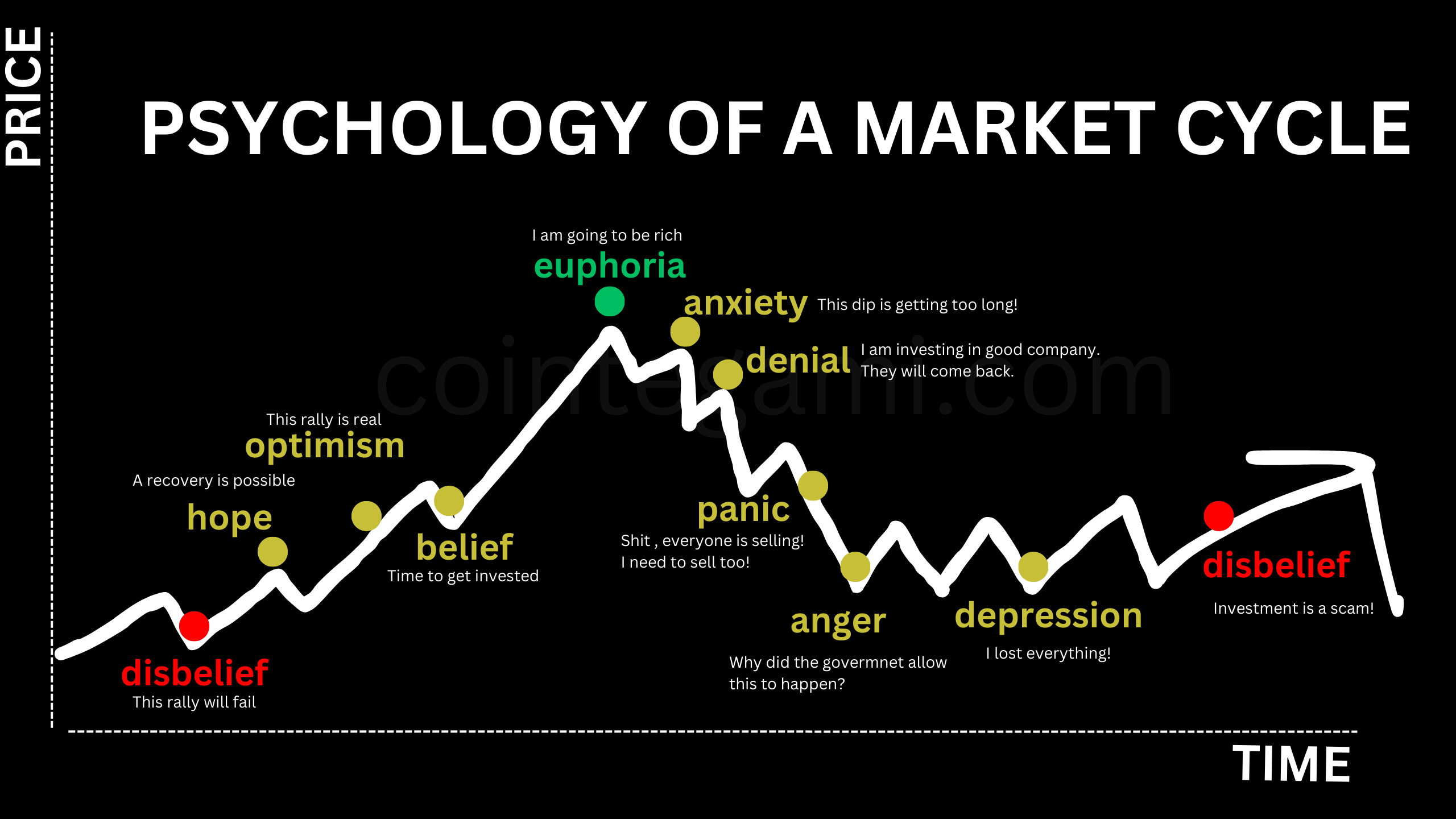

Winning Crypto Trading Chart: The Psychology Of Market Cycle

Understanding Market Cycle Psychology: The Emotional Rollercoaster of Crypto Trading

Learn how to master the crypto market by understanding market cycle psychology. From disbelief to euphoria and back—see where you are in the emotional curve and avoid costly mistakes.

Introduction: Why Emotion Drives the Crypto Market

The crypto market is notorious for its extreme volatility—but beneath every boom and bust lies something deeper: human emotion. From sky-high euphoria to rock-bottom despair, every market cycle is a reflection of investor psychology in motion.

The chart above, widely used in trading education, illustrates how emotion influences price action. By learning to recognize where you are emotionally within the cycle, you can make smarter, more rational decisions—and avoid the devastating effects of panic selling or FOMO buying.

Stage 1: Disbelief – “This rally will fail.”

The market begins to rise after a brutal downturn. Most traders remain skeptical, burned by previous losses. They call it a fakeout or “dead cat bounce.” This phase is typically ignored by the public—but it's where smart money starts buying in silence.

Pro Tip: If you're seeing low sentiment on social media and the price starts to recover, you might be in the early stages of a new cycle.

Stage 2: Hope – “A recovery is possible.”

Early signs of growth emerge. A few optimists re-enter the market, cautiously dipping their toes back in. Prices start to stabilize, and small rallies begin to form. This stage is often supported by positive news or fundamental developments.

Mindset Check: You don’t need to catch the exact bottom. Focus on whether your trading plan shows consistent signals of a shift in trend.

Stage 3: Optimism – “This rally is real.”

Momentum picks up. More investors return. Confidence builds. This is often when influencers and analysts start calling for higher prices. Volume increases as retail money begins re-entering the market.

Caution: This is often where confirmation bias kicks in. Be careful not to overexpose your capital based on early excitement.

Stage 4: Belief – “Time to get invested.”

At this point, people begin shifting from cautious optimism to full commitment. Media coverage turns bullish, and everyone starts talking about the asset again. More casual investors enter, fearing they’re missing out.

Tip: Stick to your position sizing and avoid going all-in. Overconfidence here can become a liability.

Stage 5: Euphoria – “I’m going to be rich.”

This is the top of the market—emotionally and often technically. Gains come fast. Everyone seems to be making money. Uber drivers are giving coin tips. Coins with no fundamentals skyrocket.

Danger Zone: This is where seasoned traders begin taking profits. Most newcomers, however, go all in. The belief that the market will “never crash again” is widespread—right before it does.

Stage 6: Anxiety – “This dip is getting too long.”

The market dips. Many call it a healthy correction. But some start to feel nervous. They wonder if they should sell, but hope it’s just a temporary pullback.

Emotional Trap: Traders in this phase often hold too long, fearing they’ll sell before the next leg up.

Stage 7: Denial – “They’ll come back.”

Prices keep falling. Traders justify holding their positions with statements like “This project has good fundamentals” or “This dip is just because of the news.” Emotion clouds logic.

Psychology Note: Loss aversion is in full force here. We hate realizing losses, so we hold—and often lose more.

Stage 8: Panic – “Everyone is selling! I need to sell too!”

This is the sharp downturn. News turns negative. Social media goes quiet or turns toxic. Prices crash further. Retail traders panic sell, locking in losses.

Survival Tactic: Having pre-set stop losses and a trading plan is key here. Emotions run hot. Discipline saves capital.

Stage 9: Anger – “Why did this happen?”

Blame sets in. Traders blame influencers, governments, whales—anything but their own risk management. Many leave the market. Some swear never to trade again.

Emotional Insight: This is the emotional bottom, but not yet the price bottom. It’s a period of reflection and regret.

Stage 10: Depression – “I lost everything.”

The market is quiet. Price stagnates. Those who stayed in during the crash feel hopeless. Engagement in crypto communities drops. Many sell the bottom, emotionally drained.

Opportunity Signal: Historically, this has been the smart accumulation phase—when no one’s talking, and prices are at rock bottom.

Stage 11: Disbelief (Again) – “This is a scam.”

A new rally begins—but few believe it. Once again, early gains are met with suspicion. The cycle starts anew, as emotional memory fades and market dynamics repeat.

How to Use This Knowledge to Improve Your Trading

- Know your emotions. Learn to recognize which phase you're in—and avoid making decisions based solely on feelings.

- Create a plan. Use technicals and fundamentals to guide trades, not hype or fear.

- Use journaling. Document your trades and emotions. This helps spot emotional patterns over time.

- Zoom out. Use longer timeframes to avoid overreacting to short-term noise.

Conclusion: The Best Traders Master Themselves First

The chart you just saw is more than a meme—it’s a map of the human condition in trading. The best crypto traders aren’t those who predict tops or bottoms perfectly. They’re the ones who understand that markets are cyclical and discipline trumps emotion.

Know the cycle. Know yourself. And trade with clarity—not chaos.